Personal budgeting is still popular in 2022. In fact, many people find it even more necessary to budget now than ever before. The economy has become increasingly unstable, and jobs are less secure. This has made it essential for people to be mindful of their spending and save as much money as possible. As smartphones and other mobile devices are becoming more prevalent, it is easier for people to access and use budgeting apps while on the go.

Are these budgeting apps actually useful? What does the science say?

A study published in 2020 in the European Journal of Finance tried to assess whether smartphone apps can be utilized to improve financially capable behavior. Working-age people were given four budgeting apps: one debt management app, one cash calendar app, one expenditure comparison app, and one loan interest comparison app. All these four apps were put together under a package named “Money Matters”. The people receiving these apps showed statistically significant improvements in several measures designed to gauge the participants’ financial knowledge. Those receiving the apps were likelier to keep track of their income and expenses and be more resilient when faced with a financial shock.

Another study published in 2021 in the Wiley Online Library concluded that using personal finance smartphone apps improves various measures of financial knowledge and skills, attitudes and motivations, and financially competent behaviors among low-income households.

Another research paper named Making finance fun: the gamification of personal financial management apps was published in 2021 and designed to explore how gamification increases users’ motivation and intention to use personal financial management apps and how it facilitates their adoption. The research supports the use of gamification in personal finance management apps and offers suggestions that may help fintech companies and banks persuade users to engage with their apps.

In conclusion, according to science, there are pretty decent indicators that these apps might help end users and even bring an extra boost of motivation. But currently, the number of scientific papers is pretty low, and there’s a clear need for more in-depth research on this topic.

Mobile phones are clearly more popular than in the past

There is no doubt that mobile phones are becoming more and more popular. In fact, they have become so popular that it is hard to imagine life without them. There are a number of reasons for this. First, mobile phones are extremely convenient. They allow us to stay connected with our friends and family, no matter where we are. Second, they offer a great deal of entertainment. We can use them to play games, listen to music, and watch videos. Third, they are very affordable. Thanks to technological advances, we can now get a high-quality mobile phone for a very reasonable price. This, summed up with the fact that budgeting apps seem to be useful, provides some fertile ground for an increase in popularity.

Is there a higher demand for budgeting apps?

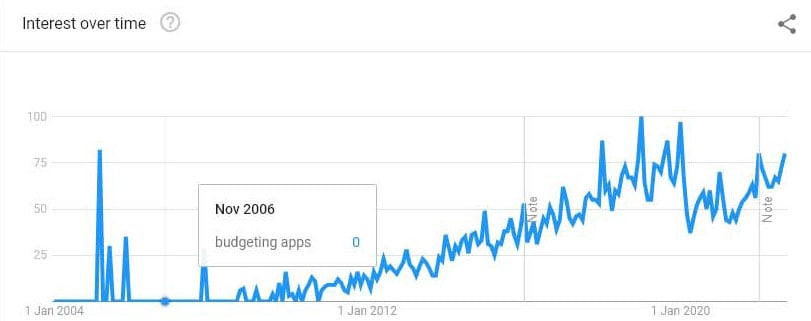

To answer this question, we can take a look at Google Trends. Google Trends is a service/platform from Google that allows users to track the popularity of particular search terms over time. It can measure the relative popularity of different topics or track changes in public opinion on a given issue. The platform also allows users to compare the popularity of different search terms side-by-side. We can use it to measure the search “budgeting apps” popularity over time since 2004.

From the picture above it’s pretty clear that the demand for “budgeting apps” has grown significantly over the years, with a few hiccups on the way. It looks like the pandemic had a negative effect on people searching for these kinds of tools.

From the picture above it’s pretty clear that the demand for “budgeting apps” has grown significantly over the years, with a few hiccups on the way. It looks like the pandemic had a negative effect on people searching for these kinds of tools.

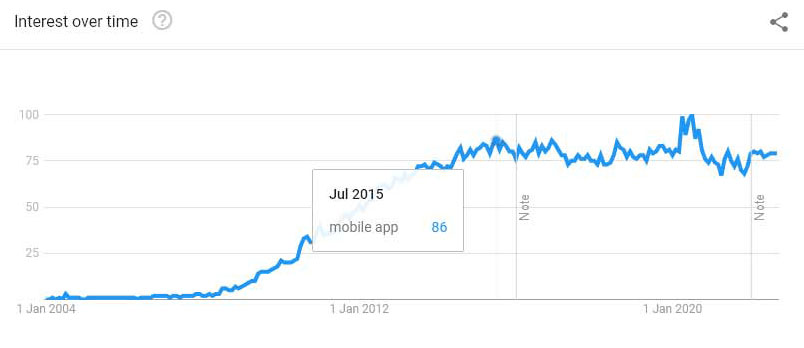

There is an interesting comparison we can make to see if the demand for budgeting apps is growing alongside the demand for mobile apps in general. We can compare the trend with the “mobile app”. You can check the image below to see the comparison:

As you can see in the picture above, the interest in mobile apps, in general, has plateaued since 2015, which is clearly not the case for budgeting apps. Since 2015, the demand for budgeting apps has probably doubled, while a similar number of people have searched for apps in general.

As you can see in the picture above, the interest in mobile apps, in general, has plateaued since 2015, which is clearly not the case for budgeting apps. Since 2015, the demand for budgeting apps has probably doubled, while a similar number of people have searched for apps in general.

Budgeting apps springing up like mushrooms after the rain

A quick search on Google Play or the App Store will reveal a number of different options, and there are likely even more that are not as well-known. Some of the more popular budgeting apps include Mint, YNAB (You Need a Budget), and PocketGuard. Each of these apps has its own unique features, benefits, or approach to help the end user. In my review of Truebill, I’ve observed it as a safe and secure option, adept at managing subscriptions and tracking expenses. For those interested in microinvesting, the Acorns app stands out. My Acorns micro-investing review details how it works, focusing on its innovative spare change investment strategy. With their individual marketing strategies, these budgeting apps aim to help users reduce spending and maintain a clear record of financial transactions.

Each of them has marketing strategies focused on increasing its adoption, and overall, they do a pretty good job at luring people in. And this could be a pretty good thing for the end user, in case they actually make a difference in reducing the overall money people spend, and keeping a clear track of where your money goes.

Is budgeting becoming more popular due to the increase in budgeting apps?

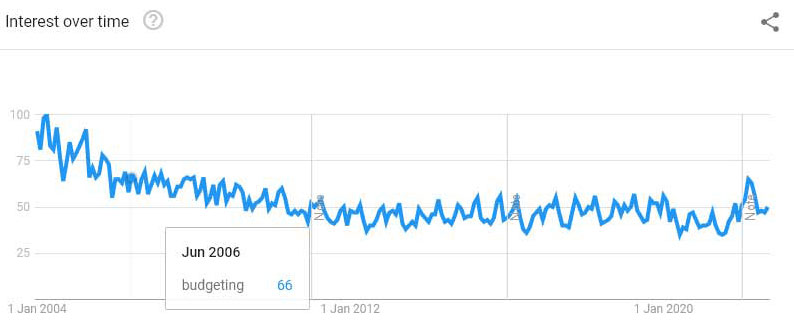

Budgeting seems to be on a downward trend, at least according to people searching for “budgeting” related stuff on Google. Check the image below; this is the trend for people searching for “budgeting” on Google:

The interest seems to be dropping. Are fewer people interested in stuff related to budgeting? Is this really the case? Why do fewer people search for general budgeting stuff, but more people search for budgeting apps? Could these apps solve some of the problems people would struggle with in the past so they don’t need to search for how to deal with them? These are all valid questions we don’t have a clear answer for, but we do have some pointers to roll with. I believe these budgeting apps will have more to do with the financial training of our younger generations.

The interest seems to be dropping. Are fewer people interested in stuff related to budgeting? Is this really the case? Why do fewer people search for general budgeting stuff, but more people search for budgeting apps? Could these apps solve some of the problems people would struggle with in the past so they don’t need to search for how to deal with them? These are all valid questions we don’t have a clear answer for, but we do have some pointers to roll with. I believe these budgeting apps will have more to do with the financial training of our younger generations.