What is Paypal?

You see PayPal everywhere, but if you’ve never dealt with it personally or read about it, PayPal is probably just a vague concept to you. So let’s define it, what is PayPal more exactly?

PayPal is a mediator that helps you buy stuff online without revealing your credit card information when you pay. You don’t have to give your sensitive information to every merchant you buy from. You give it only to PayPal, and they don’t reveal it to anyone else.

Imagine having to trust a merchant with all your credit card information every time you make a purchase. What is stopping them to re-use your credit card info whenever they feel like it?

The good news is that now you don’t have to trust all the merchants when you buy. You just have to trust PayPal. You give your credit card info only to PayPal. They keep it private and they use their bank accounts and payment agreements to pay the merchants on your behalf.

You give your payment info to PayPal, and the merchant gives their bank account to PayPal. PayPal then handles the transactions and the merchant never gets your sensitive information.

Here is an article summary, use it to jump straight to the section that interests you the most:

1) Is PayPal trustworthy?

2) Is PayPal safe against hackers?

3) How does PayPal work?

4) What is a PayPal account?

5) How to verify a PayPal account?

6) Can I send money with PayPal to friends and family?

7) What are the PayPal fees?

8) PayPal currency conversion

9) How long does it take to send money with PayPal / Is receiving money instant?

10) How to withdraw money from my PayPal Account?

11) PayPal or Wire Transfers for large sums of money?

12) PayPal subscription payments, recurring payments and automatic payments

13) How do I find my PayPal subscriptions?

14) How do I cancel a recurring PayPal payment?

15) How do I set up subscriptions on PayPal?

16) What is important to know about PayPal disputes?

17) PayPal Reviews

18) About the author

1) Is Paypal trustworthy?

When it comes to financial services, it’s hard to know whom you can trust with your credit card information, and no doubt you have some concerns when it comes to PayPal as well. So, is PayPal trustworthy?

PayPal is an officially licensed “money transmitter” and the largest and most used third-party payment provider available. With over 277 million active account holders, a huge number of employees and a regular spot on the Fortune 500 list, PayPal is a reputable and trustworthy company.

PayPal is an American company (NASDAQ: PYPL) established in 1998. In 2020, it ranked the 182nd on the fortune 500 of the largest United States corporations by revenue.

They are certainly not a shady company that nobody has heard about.

They have a physical address — with their Corporate Headquarters located at 2211 North First Street, San Jose, California, 95131 — and they can be contacted by phone at 00 1 402-935-2050.

They pay taxes like every other corporation and, with about 23,200 employees at the moment, they have been running their business for more than 20 years. For more financial information about the company visit this page.

Besides all this financial data, it’s important to know that, right now, PayPal is the largest and most used third-party payment provider available. They have more than 325 million active account holders as of January 2021, so you can rest assured you are not the first one trying a dubious service.

In the United States, PayPal is not classified as a bank – it is licensed as a money transmitter on a state-by-state basis.

Knowing that it is registered as a money transmitter should give us some peace of mind. At least we know we give access to our money to an officially licensed “money transmitter“. But state laws vary, as do their definitions of banks, narrow banks, money service businesses, and money transmitters. Because of this, in some areas the company is subject to some extra or different rules and regulations governing the financial industry.

Of course there are people who are not satisfied by their services, it’s not all sunshine and rainbows. But it’s usually on a more superficial level, concerning the quality of their service, the way they settle disputes, chargebacks and so on, and doesn’t go as deep as trust.

Regarding trustworthiness, from a “Can I trust PayPal with my credit card info?” standpoint, the simple answer is YES. There has been no major issue regarding trust from this point of view.

2) Is Paypal safe against hackers?

Even if we can trust PayPal with not giving or selling our info away, another way in which we can lose our sensitive information is by people intending to steal it from them. They may have the best intentions if their back is not covered in the safest and most secure way. So, is PayPal trustworthy enough to keep my info safe from hackers?

Even if we can trust PayPal with not giving or selling our info away, another way in which we can lose our sensitive information is by people intending to steal it from them. They may have the best intentions if their back is not covered in the safest and most secure way. So, is PayPal trustworthy enough to keep my info safe from hackers?

Even though no website can be guaranteed to be 100% “safe and secured” from hackers and PayPal is a tempting target due to its widespread popularity, their platform is secured and communication with it is encrypted so your data is kept safe from prying eyes.

PayPal have had their fair share of challenges, but overall, there seem to be no major slip-ups when it comes to security. Here you can read more about PayPal’s security.

One initiative worth mentioning related to PayPal security is the one with HackerOne.

In 2018, they teamed up with HackerOne — a platform that connects ethical hackers with organizations — and through this platform they pay (reward) ethical hackers that find vulnerabilities in their software, services or products.

So, in addition to their dedicated team of specialists, PayPal works with any smart people across the world that are capable of closely examining their code and reporting any vulnerabilities (without making them public to the world).

Just through this initiative alone, PayPal has resolved 750 reports and the average reward paid was between $1,000 and $2,000.

So you should know that the chance of them losing your financial information is very low. However, you should also know that the chance of you losing your financial data is very high.

Just to have an idea, according to this study conducted in 2017, about 1 in 15 people will become victims of identity fraud. What makes you better prepared than 14 of your closest friends?

Always be careful and educate yourself when dealing with financial information, especially when you handle financial information online. You can begin educating yourself on the National Cyber Security Center by browsing the most relevant topics there. Also, this article here is particularly important if you are serious about your security. Another good resource is this. You should also check stopfraud.gov.

Also, this paper about the electronic payment system risks written by by LJ Trautman for the UC Davis Business Law Journal could make an interesting read .

You should also know that “cyber insurance” is a thing now. If you feel overwhelmed by all this security talk, then maybe this could work for you.

3) How does Paypal work?

So now that we’ve established what PayPal is and that we can trust it with our money and sensitive information, how does PayPal work more precisely?

So now that we’ve established what PayPal is and that we can trust it with our money and sensitive information, how does PayPal work more precisely?

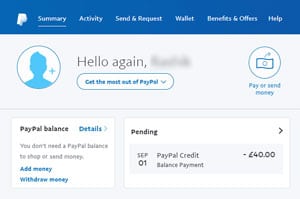

PayPal acts as a middleman for payments between two parties (between you and somebody you want to pay). First, you have to sign up for free on the PayPal website, use your email address and create a password. Then ad your debit or credit card information.

You don’t need a balance in your PayPal account because they will automatically use the preferred funding source when you try to pay for something.

Now you are ready to shop from any website that has the PayPal logo on their payments screen (meaning they accept payments with PayPal). You just have to insert your email and PayPal password at the checkout screen. PayPal will get the money from your credit card and then pay the merchant without sharing your financial details with them.

4) What is a Paypal account?

If you’ve made it this far, you probably understand by now what PayPal is and how it works, but you might still be wondering “what is a PayPal account and how can I make the best out of it?”

A PayPal account is the electronic version of your physical wallet. You can fill your wallet with cash or you can attach your bank or credit card info to it.

And because it’s digital, you have access to a few extra features like the transaction history when you set up PayPal.

PayPal has 2 types of accounts: Personal Accounts and Business Accounts. In the past, things weren’t as clear and when you wanted to create a PayPal account, it was rather confusing as there were more types of accounts, but it’s much simpler now. So what PayPal account type should I sign up for?

- The Personal account can be used to buy stuff online or send money to a friend or family.

- Business PayPal accounts are recommended for online merchants who operate under a company name.

Create a PayPal account that better fits your needs.

5) How to verify a Paypal account?

You’ve been using PayPal for a while and it all of a sudden asks you to get verified. So you may be wondering: should I verify a PayPal account? What do I have to gain if I verify my PayPal account?

You should verify your account if you find yourself in one of these two cases:

- You want to transfer more money than the limits imposed

- You want to keep a balance in your PayPal account – money that exists in digital form, not on your credit card or bank account that is associated with PayPal

All PayPal accounts are initially ‘Unverified’ and have limits on sending, receiving, and withdrawing money.

When you create a new account, PayPal asks only for essential information from you, but as you start transacting money, they are under a legal obligation to know more about you.

Having an unverified account puts limitations on some of PayPal’s most essential functions, including how much you can withdraw ($500 per month for unverified users), send or transfer to your account. Once you have reached any of the limits with your PayPal account, you must become Verified to continue using their service.

When you verify your PayPal account, you’re proving that you own the financial details added to your account. After you are Verified, they will lift limits so you can for example withdraw more money.

Verification of identity increases customer trust because it creates a higher level of confidence that a person is who they say they are. Verification increases the security of the PayPal network.

And now let’s get straight to the PayPal verification process in more detail. How do you actually verify a PayPal account? Which are the steps you have to go through to verify a PayPal account?

You should know that there are two types of verifications, and you may only need to perform one of them or both depending on your actual needs and specific situation:

| Reason for verification | What do I need to do to verify my PayPal account? |

| Increase spending or withdrawing limits | Confirm that you actually own the credit/debit card or bank account by providing bank statement information |

| Keep a balance in your PayPal wallet | Confirm that you are who you say you are by providing a few documents |

Verifying for increasing your spending and withdrawal limits

The Verification process for this varies by country or region. For example, in the U.S., a Verified member has added and confirmed a bank account with PayPal. In Germany, a Verified member has completed a bank transfer or the Expanded Use Process. In most countries and regions where PayPal is available, a Verified member has added a credit card and completed the Expanded Use process.

If your account hasn’t been verified, you can choose to add and confirm your credit/debit card or bank account.

– Confirming your bank account: they will send two small deposits to your bank account. You’ll need to check your bank statement and enter the two amounts of the deposits in your PayPal account.

– Confirming your credit/debit card: they will charge your card a small sum of money and send you a 4-digit PayPal code. You’ll need to check your card statement for the code and enter it in your PayPal account. The charge will be refunded to your card after you’ve completed confirming this card. The refund may take up to 30 days to appear on your card statement.

Verifying for keeping a balance in your PayPal wallet

This verification is also called PayPal’s Customer Identification Program (CIP).

There is a US law that requires all financial companies to prove the identity of their customers in order to carry a balance. This process might not be required if you pay the merchant straight from your funding sources, meaning from your credit card or bank account, without having a balance in the PayPal account.

If, however, you want to keep money in your PayPal account, or use other features that require a balance, you have to go through PayPal’s Customer Identification Program (CIP).

To be compliant with the regulation, all users must be verified for the following information: full name, primary address and Social Security Number. Users must verify their identity by submitting proof documents:

- For proof of legal name: Driver’s license or passport

- For proof of address: Driver’s license, passport, or utility bill

- For proof of SSN: SSN card, ITIN card, or federal tax form

After you submit these documents, they will be manually reviewed by somebody from PayPal. If they pass verifications, you will be able to use all the balance-related features.

6) Can I send money with Paypal to friends and family?

You might have a friend or relative living far away and you want to send them money. Can you use PayPal to send them money?

Whenever you send or request money through your personal PayPal account, you can choose whether it’s a “Friends and Family” payment or a “Goods and Services” payment. For some countries, the “Friends and Family” payment option might not be available.

You can use PayPal to send money to friends and family, but is it free or is there a friends and family fee?

If you are located in the US and you send the money from your PayPal balance or bank account to friends and family, sending money is free. Neither you nor the recipient will pay any fees. However, there is a fee if you want to send your money from a debit or credit card, and if you are sending money internationally you may be charged a transaction fee equal to 5% of the sent amount (up to 4.99 USD).

So it really depends on your funding source and location.

But exactly how much you will pay in fees in these cases is impossible to put in a fixed number, because it might vary based on your location, on the receiver’s location, types of currency, and so on. You should check out this table and try to figure it out based on your particular details.

Because this kind of transaction is free (if done the right way), some businesses might request that you make a purchase and pay using the Friends and Family feature so that there will be no fee required. You should not do this because this is explicitly against PayPal’s User Agreement -> “You must not use the ‘send money to a friend or family member’ feature in your PayPal account when you are paying for goods or services.” It’s also important to know that you can get scammed very easily when you try to do something like this. PayPal does not reimburse payments sent using PayPal’s friends and family functionality.

So if you send money using the friends and family feature to a business, you will probably not get it back through any kind of dispute.

After you send money to your friend or family, the money is credited to their account. They will receive an email notifying them that a payment has been received. As long as their account is not subject to any sort of hold, they will be able to withdraw the money to their bank account or credit card. Check below how the withdrawal process will work.

7) What are the Paypal fees?

PayPal’s fee structure is so convoluted it really makes you think that they made it like this on purpose. Here, take a look for yourself.

Now let’s take a deep dive and try to extract whatever we can out of that mess.

|

PayPal Fees |

|

| FREE | For purchases When sending money to friends For withdrawals to your bank account |

| $2.50 per withdrawal | For withdrawals to your credit or debit card |

| $0.30 + 2.9% of the transaction amount | When receiving money from commercial transactions (US) |

| 4.4% of the transaction amount + fixed fee | When receiving money from commercial transactions (other countries) |

| 3.75% on top of the base exchange rate | For currency conversions |

But I insist strongly that you don’t rely on summaries made by others (including myself) and you check and confirm everything with your own eyes — this is even more important because their fees might change, while articles and content you find online might not. Most of the online content you’ll find will not be up-to-date. So, here’s how it is at the moment, in more detail than the table above:

– It’s free to use PayPal to pay for a purchase or any other type of commercial transaction (unless it involves a currency conversion). This means that you don’t pay a fee when you buy something. The price you see in any online shop at checkout will be the final price you pay, with no transaction fee added to it.

– It’s also free when you make “personal transactions” when the sender and receiver are both in the same country. PayPal calls it a “personal transaction” when you make or receive payments initiated from the “Friends and Family” tab. This implies that the payment is not made for the purchase of goods or services.

– You pay fees when you receive any “commercial type of transaction”. This means from anything you might be selling in any business examples, such as e-commerce, consulting, service-based businesses, start-ups, or online businesses, from any donations, or when you “request money”. . Basically anything that might be a “commercial transaction”. To find out exactly how much, check the merchant fees here. The standard merchant fee for a US seller selling to a US customer is $0.30 + 2.9% of the transaction amount. If you are based in a different country, the amounts will be slightly different: 4.4% of the transaction amount + fixed fee, depending on which country you’re receiving from. There are also fees for changing currency: 2.5% of the transaction amount.

– You pay fees in some cases when you withdraw money. Withdrawing to a bank account is free. But withdrawing to your credit or debit card is not. If you withdraw to your credit card it will cost you $2.50 per withdrawal, and you can withdraw up to a max of $2,500 per transaction. This sum will vary for each country, but it should be somewhere in this range in the local currency.

In conclusion: PayPal fees are usually paid by the merchants who sell, and not by the people who buy.

This might make you feel all warm and fuzzy inside, and give you the extra peace of mind of not having to worry about transaction fees. But merchants have to factor in all of these fees in their final price. Otherwise they won’t be able to stay in business. And eventually, guess who’s the one paying, even if you don’t have to worry about it…

Another commonly neglected way in which PayPal makes money off of you is from currency exchanges. Check out the following chapter about currency conversion through PayPal.

8) Paypal currency conversion:

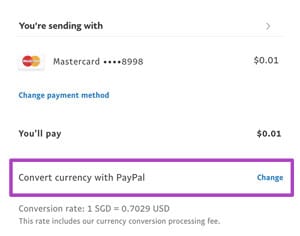

For currency conversion, PayPal charges 3.75% on top of the base exchange rate within the wholesale currency markets.

For currency conversion, PayPal charges 3.75% on top of the base exchange rate within the wholesale currency markets.

So, if you want to pay for goods or services in a currency other than the currency they are listed in, PayPal will have to do a currency conversion. They will charge the standard conversion rate + 3.75% on top of that rate. This changed in September 2019 and it will probably change again in the future. If you have to know the exact number, you can check the “How to convert currency” section in the PayPal User Agreement.

Where can you find the PayPal currency exchange rate?

1 – Go to your Wallet page.

2 – Click Currency Calculator.

9) How long does it take to send money with Paypal / Is receiving money instant?

PayPal transfers are famous for being quick, with most of them being instantaneous, but let’s see exactly how long it takes to send and receive money with PayPal for each type of transaction:

| Type of PayPal transfer | How long does it take |

| From a PayPal balance to a PayPal account | Instantaneous |

| From a PayPal account (using a credit or debit card) to a PayPal account | Instantaneous |

| From a PayPal account (using a bank account) to a PayPal account | 3 to 5 business days |

It all depends on your selected funding source, so let’s look at it in more detail:

– How long does it take to send money from a PayPal account balance to another PayPal account (or merchant)? -> these transfers are usually instantaneous

– How long does it take to send money from a PayPal account using a credit or debit card as a funding source – to another PayPal account (or merchant)? -> these transfers are usually instantaneous

– How long does it take to send money from a PayPal account using a bank account as a funding source – to another PayPal account (or merchant)? -> When transferring money this way, usually you have to wait three to five business days before the money appears in your PayPal account. However, in 2019, PayPal started adding the instant transfer feature, first for US residents, then for the rest of the world (by the time you are reading this article there is a high chance that your area is also covered).

An Instant Transfer is a way to send money or make a payment from your bank account instantly using PayPal. The seller is credited immediately while the request for the money from your bank is processing. You need to have a confirmed U.S. bank account and a backup funding source, such as a credit card or debit card registered on your PayPal account, to complete an Instant Transfer.

If your bank declines your transfer the first time, they will try to retrieve the money a second time. If the second attempt also fails, the Instant Transfer is charged to the backup credit or debit card used for the payment. In some countries, sending payments from a bank account may not be available. It usually takes 90 seconds until the Instant Transfer appears in your bank account, but PayPal states that it can take up to 30 minutes – depending on your bank. This type of transfer has additional costs, you have to pay a fee of 1% of the transferred amount, with a maximum of $10.

There is another thing you have to take into account when it comes to how long it takes to send and to get money into your PayPal account. If a new created PayPal account receives a large amount of money in a short time, PayPal might hold any payment for investigation for 21 days. So, in some special circumstances, there is the possibility that everything might take more time.

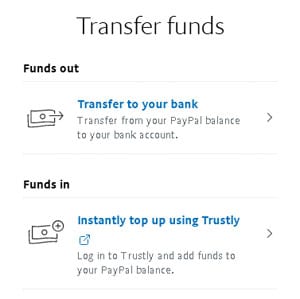

10) How to withdraw money from my Paypal Account?

How do you get the money when someone pays you through PayPal? It’s actually quite simple to withdraw money from your PayPal account.

After the money is credited to your PayPal account, you will receive an email that the payment has been received. As long as it isn’t subject to any sort of hold, you’ll be able to send it to your bank account using the “Withdraw” > “Transfer to bank account” link on the main PayPal page. Just follow the indicated steps.

You can withdraw money from your PayPal account to your bank account at no cost. But, as we mentioned in the Fees section above, if you withdraw money to your credit or debit card, this will cost you $2.50 per withdrawal, and you can withdraw up to a max of $2,500 per transaction. This sum will vary for each country, but it should be somewhere in this range in the local currency.

11) Paypal or Wire Transfers for large sums of money?

Is PayPal a good idea when you want to send large sums of money or are you better off with a wire transfer?

In case you want to send large sums of money, bank-to-bank is a much better alternative than using PayPal. PayPal will analyze each transaction to make sure it conforms to their security and risk parameter, as well as government money regulations.

So sending large sums of money through PayPal might be more complicated and you’d probably get more help by going to your local bank to enquire about international money transfers and what procedure they follow.

12) Paypal subscription payments, recurring payments and automatic payments:

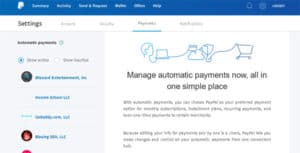

If you don’t want to worry about paying for your subscriptions or for your recurring services (like hosting, streaming services, Patreon), you should know that PayPal has a system in place to handle them without interrupting your day.

When a subscription is paid, you will automatically receive an email notifying you that the payment has been made, requiring no extra input from you.

These automatic payments are usually set up on the website from which you want to make a purchase. You might have two options, first to just pay, second to pay and also create a subscription for future payments.

13) How do I find my Paypal subscriptions?

1) Log into your PayPal Account

2) Click on the settings cogwheel icon in the top right corner

3) Click on “Payments” – the third sub-tab that appears below the main menu

4) Click on the “View” link near the “Manage your Automatic Payments”

Most of the online tutorials and guides covering PayPal subscription are not up-to-date. PayPal have changed their interface many times, so don’t feel bad if you were mislead into finding imaginary menus and clicking on non-existing links. Even PayPal’s own help section is guilty of this. It hasn’t been updated in a long time and it’s still wrong.

14) How do I cancel a recurring Paypal payment?

1) Log into your PayPal Account

2) Click on the settings cogwheel icon in the top right corner

3) Click on “Payments” – the third sub-tab that appears below the main menu

4) Click on the “View” link near the “Manage your Automatic Payments”

5) Click on the specific subscription you want to cancel, and then hit the “Cancel” button.

Most people who shop online try to talk to the merchant to get their PayPal subscriptions canceled. This is a waste of time, because the subscription is made in your PayPal account, and the merchant does not have access there to cancel it. So you have to cancel the recurring payment from your own account.

You should also know that if you cancel a PayPal subscription, you will cancel the future automatic renewal (recurring payment), but it will not affect the current membership already paid, even if there are a few months left.

Merchants give discounts if you pay in advance. The bigger the timeframe for which you pay in advance, the bigger the discount. You already made the deal and enjoyed the benefits. You can’t go back and re-do it. I mean you can, but it’s probably a waste of time.

You should also know that a subscription can be cancelled up until the day before the next scheduled payment in order for you not to be charged.

How do I upgrade or downgrade a PayPal subscription?

Most subscription services have different plans that cover different needs. If you find yourself in a situation in which you want to upgrade or downgrade a subscription, you should know that the best solution is to cancel the current subscription, and then to create a new one.

This is usually a hassle for both merchants and clients, but there is no easy way around it. There are some “modify subscription” buttons that can be set up by merchants, but that is not an easy task to do, and part of the documentation points to inexistent pages on PayPal’s website.

15) How do I set up subscriptions on Paypal?

1) Log into your PayPal Business account

2) Click on Tools

3) Click on Recurring Payments

4) Follow the step-by-step instructions

If you are a merchant, setting up a subscription service for your clients is a bit more complex. PayPal’s recurring payments allow you to bill your customers at regular intervals. The most important thing you have to know is that there is no additional fee added just because a transaction is recurring. PayPal currently supports two types of recurring payments: fixed recurring payments and per user/seat recurring payments. Start here.

16) What is important to know about Paypal disputes?

When it comes to filing and resolving complaints, PayPal will try to treat both sellers and buyers fairly, while guiding both through the PayPal dispute resolution process.

Disputes / Claims:

– Item Not Received (INR)

– Significantly Not As Described (SNAD)

– Unauthorized Transaction

If a buyer initiates a dispute, the seller will receive an email about it and will see it in the Resolution Center. The money the seller received for the transaction may be unavailable during the case investigation. Once a dispute is opened, you have 20 days to work with the buyer to resolve it (PayPal won’t be involved at this point).

If a claim is filed, the seller is asked to respond within 10 days. If the seller doesn’t respond, the claim will automatically close in the buyer’s favor, and a full refund will be issued. If the seller does respond, PayPal will work to evaluate the information provided and determine the outcome of the claim.

This process usually takes about 30 days, but more complex cases could take longer than 30 days.

Having a claim filed against you doesn’t necessarily mean you’ll be penalized. There are no automatic fees levied against you, and your seller feedback won’t automatically be affected.

However, if a claim rate is too high or other indicators are trending negatively, your account could be reviewed, and reserves or limitations could be put in place.

Chargebacks or Bank Reversal

A chargeback is when a buyer asks their credit or debit card issuer to reverse a transaction after it’s been completed. They are available only to buyers who make a payment with their credit or debit card. Because they are initiated with and decided by the debit/credit card issuer (not PayPal), the process is bound by the card issuer’s regulations and time frame. When PayPal is notified of the chargeback, they will send you an email to let you know about it. A case will also be generated in the Resolution Center at this time. Once a chargeback has been filed, you’ll have 10 days to respond to it. The chargeback process could take 75 or more days to be resolved. During this review process, a temporary hold may automatically be placed on the transaction funds and will be released back to you if the chargeback is settled in your favor. Though in this case the debit/credit card issuer determines the outcome, PayPal is there to help you through the process. For instance, PayPal will compile internal information and combine that with information you provide to dispute a chargeback, per credit/debit card guidelines. Simply having a chargeback filed against you will not automatically affect your seller feedback.

A bank reversal, sometimes called an ACH return, is when PayPal receives a request to return funds for a transaction that was funded by a bank account. This request might come from the buyer or the bank itself. Usually this request is filed because of suspected unauthorized use of a bank account. The next steps will depend on how you choose to respond. You’ll be instructed about any additional information you need to provide that can help PayPal resolve your case, such as entering a transaction ID to prove that a refund has been issued or adding context for accepting the liability. In some instances, you may not be liable for the reversal.

If you are interested in finding more about how to handle claims, chargebacks and bank reversals with PayPal, you should know that there is this book named “PayPal Hacks – 100 Industrial-Strength Tips & Tools” written by Shannon Sofield, Dave Nielsen & Dave Burchell that covers some in-depth strategies on how to handle these types of claims. Dave Nielsen has a Bachelor of Science degree in Business from California Polytechnic State University in San Luis Obispo, and it would be interesting to check out the suggested approaches and strategies for solving problems related to PayPal.

17) Paypal Reviews

PayPal is one of the companies with the worst reviews in terms of customer service satisfaction. It may be very good in terms of trustworthiness and security (as mentioned in detail in the paragraphs above), but in terms of customer service and satisfaction and customer care, it is a real mess. Just to give you an example, they have a 1 out of 5 star rating on Trustpilot out of about 10,000 reviews.

PayPal is one of the companies with the worst reviews in terms of customer service satisfaction. It may be very good in terms of trustworthiness and security (as mentioned in detail in the paragraphs above), but in terms of customer service and satisfaction and customer care, it is a real mess. Just to give you an example, they have a 1 out of 5 star rating on Trustpilot out of about 10,000 reviews.

What are the most frequent complaints and the most common problems?

– buying from Chinese suppliers that send you junk, and PayPal closes the dispute in favor of the Chinese supplier just because they supplied a tracking number (they just investigate at a superficial level)

– getting your money locked in your account’s balance for very long periods of time (months) because their customer support team acts superficially, takes a long time to answer, and does not really put an effort into solving the issues. The best example for this is Minnie Small’s story that you can listen to and watch in this video.

– customer support during COVID-19 is equal to zero

– people who are victims of online fraud. Somehow, somebody got a hold of their login details and bought something from their account. If the item was delivered, there isn’t much that can be done. PayPal denies the claim, stating that the item was delivered and sides with the seller. And investigations seem to stop there. At least from PayPal’s part.

In defense of PayPal, there are also a lot (meaning a truckload) of people complaining about PayPal – when the real issue is that they bought the stuff from an untrustworthy supplier. There’s not much PayPal can do in this case. When something bad happens, a lot of people go into frenzy mode and blame everything in their sight, including PayPal. And if we look under the hood: when you throw money at an untrustworthy supplier, there is a big chance you won’t see it again. To avoid this, be sure to always check the reputation of the company or the supplier you want to acquire something from. Always check their negative reviews and make sure that whatever bothers you is not a repeating topic in the complaints section.

About the author:

This article has been written by Remus Zoica, with the goal in mind to help any beginners understand what PayPal is, how to use the system and avoid any problems on the way. Remus Zoica has a Bachelor’s Degree in Economics from the University of Oradea and has been using PayPal for more than 15 years. He has worked with financial related companies and products, and over time he has noticed that there is no real “beginner’s guide to PayPal” on the Internet. Most of the online information is presented with the assumption that users already know sophisticated terms and jargon. So this guide was born from seeing the lack of information and resources available to beginners who don’t know anything about PayPal.

Even though this article is long and comprehensive, there are surely a lot more questions beginners might have about PayPal. That is why this article is a “work in progress” and it will be constantly updated with important questions and relevant answers. You can participate as well, feel free to use the comments section below to ask any question about PayPal.