Before delving into the details of my experience with the Acorns app, I’d like to make it clear that my intent in writing this review is purely to provide an honest perspective. I have not been incentivized, paid, or swayed in any way to favorably represent this app. My hope is to provide genuine insight for the everyday individual seeking information about Acorns, ensuring that they can make an informed decision. I’m Remus Zoica, the creator and main writer behind responsiblebudget.org. Now, if you’re asking yourself why you should trust my insights on Acorns or any other financial tool, let me provide some context. Firstly, I have earned my stripes with a bachelor’s degree in Economic Engineering, equipping me with a profound understanding of financial systems and economic intricacies. But trust me, it’s not just the theory I lean on. With over a decade of hands-on experience in the field, I’ve navigated the complexities of personal finance time and again.

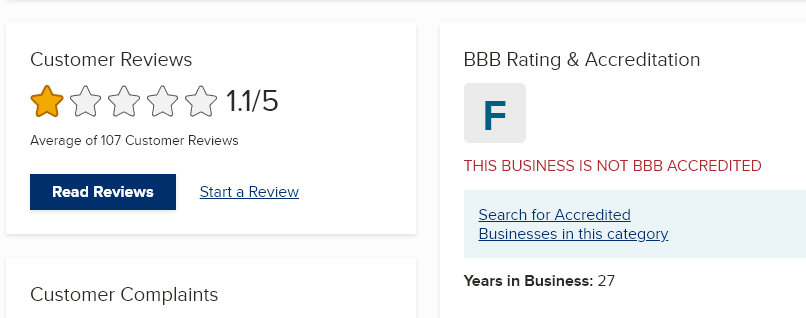

What prompted me to write this article, however, was the overwhelming number of negative reviews Acorns has received on various review platforms. Just take a look at the screenshot below. It’s a representation of the sentiment many users seem to have, and I felt it was important to provide my own, informed perspective amidst this backdrop.

This stark disparity becomes even more intriguing when you contrast these negative sentiments with the glowing reviews Acorns has garnered on major websites like Forbes, NerdWallet, and CNBC. So, what is the real story here? What’s the underlying truth? Are these prominent publications heavily incentivized, while the average Joe is left in the dust, potentially bleeding money? These discrepancies propelled me to delve deeper, to navigate the fine line between sponsored content and genuine user feedback. Join me as we unravel this financial mystery together!

With a burning curiosity, I began to comb through the feedback on various review aggregator sites, most notably Trustpilot and the Better Business Bureau (BBB). My initial impression? Something didn’t quite add up. As of my last check on Trustpilot, out of the 347 reviews, a staggering 25% were gleaming 5-star reviews, while an even more eyebrow-raising 65% were 1-star reviews. Such a polarised distribution is not just unusual; it’s downright suspicious. A natural dispersion of reviews would typically reflect a gradient of user experiences, from highly satisfied to thoroughly disappointed. But this? It screams of manipulation, hinting that there’s more than meets the eye. So, the next question arises: amidst this sea of skewed feedback, how do we discern genuine grievances from manufactured negativity and sincere accolades from possible incentivized flattery? Let’s embark on this investigative journey and sieve out the real from the reel.

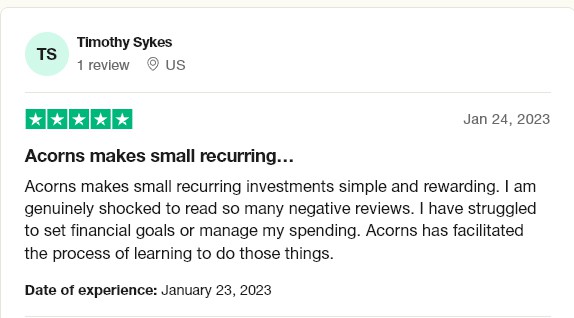

When scrutinizing positive online reviews, it’s essential to be wary of potential manipulation tactics, such as incentivized feedback, review farming, internal pushes from company affiliates, and selective review removal. Authentic reviews typically delve into specifics, while generic or overly vague praises can be potential red flags. I was genuinely taken aback when I came across the first review showcased in the screenshot below:

The review emphatically stated: “Not sure why anyone has had difficulties with this company.” This comment, in itself, is telling. It reveals that even those leaving positive feedback are acutely aware of the overarching negative sentiment surrounding Acorns. Such a remark underscores the palpable disparity in user experiences. While this particular user may have had a smooth journey with the app, they’re not oblivious to the contrasting stories from other users. And this revelation was just the tip of the iceberg. As I continued my exploration, I found that this wasn’t a lone voice in the wilderness. Several other positive reviews seemed to acknowledge, either directly or indirectly, the prevailing negative feedback while simultaneously sharing their contrasting, positive experiences. To give you a clearer picture, here are a few more examples:

This sentiment was further crystallized by the concluding words of one reviewer: “I hope I never come across what has happened to the other reviewers.” This statement was nothing short of mind-boggling to me. Given the volume of detailed feedback, one would assume that the grievances of unsatisfied users would be transparent. However, the tone of this comment suggests an air of mystery surrounding these adverse experiences, as if there’s some inexplicable, almost mystical force at play that only affects a select group of users.

It’s unsettling to think that some users feel like they’re tiptoeing around a potential pitfall, uncertain of when or if they might encounter the issues others have described. This ambiguity, this sense of playing Russian roulette with an app, is hardly what one would expect or desire from a financial tool meant to foster trust and security.

This deepens the intrigue and frames the review discrepancies in a more dramatic light, emphasizing the uncertainty and unpredictability of user experiences with the app.

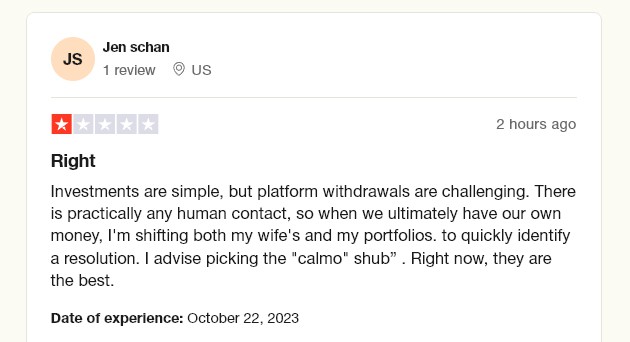

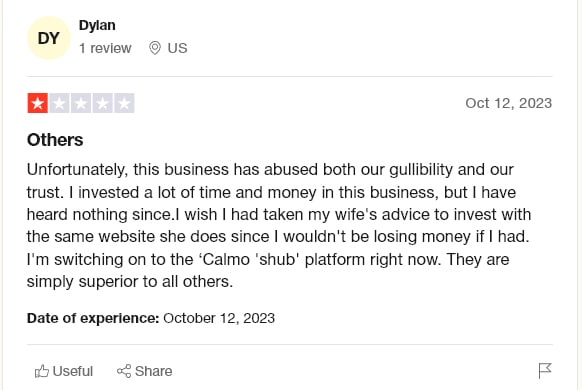

Ok, so the next step is to find the obvious pitfalls, especially the ones that repeat the most in public Acorns user reviews, the ones that pop up over and over. Let’s dive deeper. After checking a dozen negative Acorns reviews, I still wasn’t able to extract a clear negative perspective on the Acorns app, but I’m starting to identify another type of pattern. Look at these 3 reviews:

These Acorns reviews seem to be pushing an unrelated agenda, specifically mentioning “calmo shub” and “plutonium investments”. I strongly recommend steering clear of these mentions. They are fresh, published from August to October 2023, there are a lot of them. They have some common characteristics:

- These kinds of reviews are numerous, interspersed occasionally with some genuine reviews.

- They are vague, and the language used appears to be “spun”. By “spun”, I mean that the text has likely been processed or rephrased by software to make it appear unique, even though the core content might be duplicated (like the “calmo shub” in the screenshots above). Here is a basic example of spun text, where the original sentence is: “The quick brown fox jumps over the lazy dog.”. A spun version would be: “The speedy tan fox leaps above the idle hound”. As you can see, the spun version retains the core meaning of the original sentence, but the words have been swapped out for synonyms or slightly altered to make it appear different. And yes, it sounds weird, much like many of these reviews. Now, I’m beginning to grasp why people couldn’t pinpoint what was off when going through these reviews.

- They appear to be frequently removed by the website hosting the reviews. There were some I had noticed when I began writing this review, which have since vanished, yet many new ones spring up like weeds. It’s evident that public review platforms are struggling to manage them.

- Since including links is prohibited, they grapple with directing the user toward the intended advertisement, as with the “plutonium investments” review mentioned earlier. If they are too overt, they likely face deletion; if too ambiguous, they serve no purpose. That’s why the majority tend to lean toward being vague.

- These reviews appear to be posted automatically. I came across a user who posted strikingly similar reviews to Acorns, Acorns Lettings (a property management company), and Acorn Estate Agents (which is South East London and Kent’s Leading Estate Agency Group).

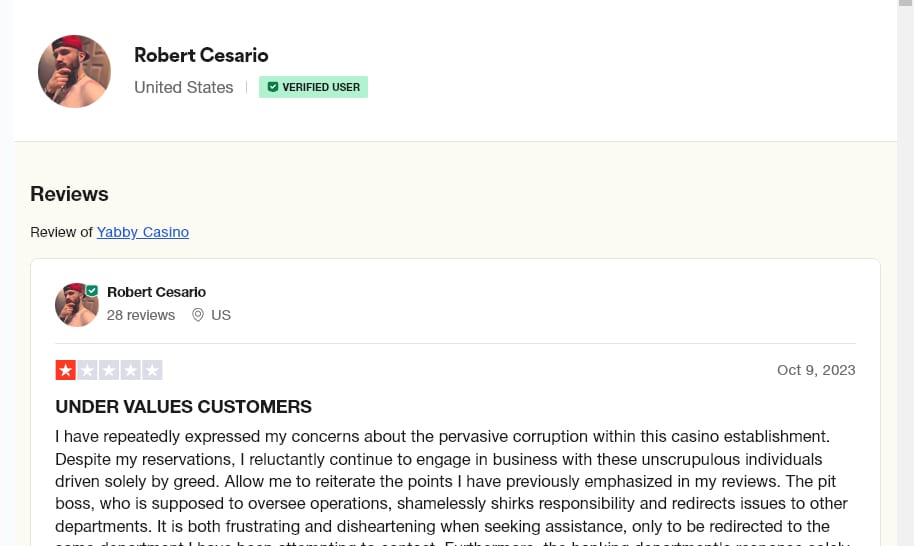

- The profiles that post these reviews don’t represent real individuals. They either have just one review attributed to them or dozens of negative reviews for various apps they target with advertisements. For instance, the profile in the screenshot below had 28 negative reviews targeting casinos, all posted within the span of a few weeks. Here is an example in the screenshot below:

Conclusion:

Why are there so many bad Acorns reviews?

The prevalence of negative Acorns reviews is largely due to individuals aiming to promote something. They exploit public review platforms for this purpose, particularly the sections dedicated to negative feedback. However, it’s important to note that not all negative reviews fall into this category. After sifting through hundreds of negative reviews for Acorns, I estimate that somewhere between 50% to 75% resemble these promotional types. A significant portion still consists of genuine users voicing authentic concerns and issues. We’ll delve into these genuine reviews shortly.

But what do the genuine Acorns reviews reflect?

Most of the user reviews, and my personal experience reflect this:

Pros:

- It’s a safe ‘set and forget’ method to save money. Rounding up your spare change can accumulate quickly, especially if you engage in numerous transactions each month.

- It’s one of the simplest methods to invest money automatically. Notably, the automatic weekly investment feature enhances this convenience, allowing for consistent contributions over time.

- Through Acorns you can invest in ETFs, they can be a relatively safer investment option compared to individual stocks.

- A majority of the negative reviews seemed to have an ulterior motive, often promoting something. Coupled with dubious user profiles, signs of automation, poorly constructed language, and outright misinformation, I’d estimate that this accounts for up to 75% of them. Even individuals who posted positive reviews were taken aback by the sheer number of negative ones, often responding with comments such as: ‘I am genuinely shocked to read so many negative reviews’, ‘I hope I never experience what has happened to the other reviewers’, and ‘I was shocked to see the majority of reviews since the app has been nothing short of fantastic for me. It was not obvious to them that most were fake.

Cons:

- Even though it may look cheap, it has high fees on small account balances due to the pricing structure. This will be explained later in the article.

- No tax strategy – this means that it doesn’t offer specialized tools or methods to minimize the taxes you might owe when you decide to take those profits out or sell your investments.

- Opening accounts is straightforward, but closing them can be more challenging. Many users have reported difficulties when attempting to close their accounts.

- There are complaints about customer support, yet there are praises as well. This is a nuanced topic, and I’ll provide more detailed explanations in the following sections.

- Some users express concerns over hidden fees. Yet, the main issue appears to stem from a system where users easily subscribe to a low-cost plan, only to forget about it. When later faced with the charges, they voice their complaints, often feeling there’s little recourse.

- There’s a flat fee ranging from $3 to $5. In unique scenarios, particularly when there’s limited transactional activity, one might earn less than this fee, effectively resulting in spending rather than saving. However, this is reserved for particularly extreme cases.

- Acorns is for investing, not for trading. This doesn’t appear to be evident, as many users have expectations akin to those set by trading app comparisons.

- Many fake negative reviews – I list this under the cons because if these aren’t addressed, they could significantly tarnish the Acorns brand image and deter potential users.

What is Acorns best for?

Acorns is best for people who genuinely want to save but consistently find it difficult. It caters to those who, in theory, have the means to save but can’t seem to make it happen in practice.

What makes Acorns stand apart from the rest?

What sets Acorns apart is its unique ability to merge savings with micro-investments. This approach allows users to take two simultaneous steps toward enhancing their financial well-being. At the heart of this combination lies the power of the compounding effect. Compounding, often dubbed the ‘eighth wonder of the world,’ is when the interest or returns on an investment start earning interest on themselves. Over time, even small, consistent contributions can grow exponentially due to this effect. It underscores the idea that consistent, disciplined savings and investments, even if they’re modest, can lead to significant wealth accumulation over an extended period. With Acorns leveraging this principle through its micro-investments, users not only save but also see their savings amplify over time.

How Does Acorns Work?

Imagine every time you buy a coffee for $2.50, Acorns takes it as $3 and puts that extra 50 cents into a special savings jar. That’s your spare change. On top of that, you can tell Acorns to take, say, $5 every week from your account and add it to that jar. Now, instead of just letting that money sit there, Acorns invests it for you in a mix of stocks and bonds. So, over time, your money isn’t just sitting still; it’s out there working and growing, kind of like planting a small seed and watching it turn into a tree. The more you spend and save, the more seeds you plant!

Acorns fees and costs

Acorns is like a fixed-price buffet, where you pay $3 every month, no matter how much or how little you eat. So even if you only invest a small amount, like $100, you’re still paying that $3 every month. Now, let’s look at an alternative app called Betterment. Instead of a fixed price, they charge you based on how big your meal is. For a $100 investment, they’ll only take 25 cents a year. That’s their way of charging – a tiny percentage of your investment. So, when comparing the lowest fees, if you’re investing just $100 for a year, with Acorns you’d end up paying $36 ($3 every month), while with Betterment, you’d only pay 25 cents. It’s like choosing between a flat buffet price and paying for exactly what you eat. In simple terms, the Acorns flat fee is tough on small accounts but can be a bargain as you invest more, while the percentage fee at Betterment gets pricier the more you invest. Even though Acorns has that set fee every month, it’s pretty much as low as you can get, almost like the price of a coffee. And given all the cool stuff and benefits the app offers, I’d say it’s a solid deal. To make the most of it, consider growing your investment in Acorns quickly. The bigger your investment gets, the more that flat fee starts to look like spare change. So, if you hustle and grow your Acorns portfolio, soon enough that $3 monthly fee will feel even smaller than the percentage you’d give to Betterment. It’s all about making your money work smart for you!

No tax strategy

When you invest money, sometimes you make profits (which is great!), but when you decide to take those profits out or sell your investments, you might have to pay taxes on those profits. Now, there are certain ways or strategies to manage and organize your investments to potentially reduce the amount of taxes you owe. This whole process of managing investments to be tax-efficient is what’s referred to as a “tax strategy.” When people say Acorns has “no tax strategy,” they mean that Acorns doesn’t offer specialized tools or methods to minimize the taxes you might owe when you sell your investments. Some other investment platforms might offer features like “tax-loss harvesting,” which is a fancy term for selling investments at a loss to offset any profits and thus potentially reducing your tax bill. So, in simpler terms: Acorns is like a basic car – it’ll get you from point A to point B, but it doesn’t have all the high-end features. If you’re looking for those special features to minimize taxes, you’d need to check out other investment platforms or consult a tax expert. But for many folks just starting out or looking for simplicity, Acorns does the trick.

Customer service and support

While there’s been significant negative feedback regarding Acorns’ customer support, a deeper analysis suggests a more nuanced picture. Numerous negative reviews appear to be disingenuous upon closer examination of the user profiles and their respective review histories. Beyond these potentially spurious reviews, genuine concerns seem to coalesce around four primary categories:

- Not getting fast and easy money from their referral system

- Paying subscription without being aware and then complaining about not getting their money back, not getting solutions from the support team

- Not having their issue solved, for example, “I have called 4 different times, sent 2 emails, and spoke with a manager. I have yet to have the issue resolved. It’s been over 3 weeks, and I’m beyond frustrated.”

- issues linking bank accounts

I’ll delve further into each of these categories to provide you with a clearer context. This will enable you to ascertain whether these issues genuinely stem from the customer support team or if they originate elsewhere. I’d also like to make an unequivocal statement: I have no financial ties to Acorns. I’m not receiving any form of compensation, nor do I stand to gain from presenting this analysis. My intention is solely to provide a balanced and informed perspective.

- Numerous user reviews have expressed frustration over difficulties withdrawing funds after referring friends to Acorns. It seems many might have been under the impression that the referral system would grant them quick and easy money. However, the reality is that one must submit proper identification to maintain an online balance and facilitate withdrawals. “KYC” stands for “Know Your Customer.” It’s a process that banks and other businesses use to verify the identity of their clients. Think of it like when you show your ID to prove who you are before opening a bank account or getting a new phone line. They just want to make sure you are who you say you are! And the customer support team is left to manage the influx of frustrated individuals who believed they could access the money with ease.

- It appears that a significant number of users were unaware they had subscribed to a service. Most likely, they forgot about it, and upon noticing the charge on their bank statement, their frustration grew. This led to a surge in outreach to customer support, with many seeking refunds. Naturally, in such situations, refunds aren’t typically granted. As a result, you have a multitude of upset individuals airing their grievances, feeling that the support team hasn’t provided adequate solutions.

- Many users voice their frustrations, stating things like “I’ve called 4 times, sent 2 emails, even spoken with a manager. Yet, after over 3 weeks, my issue remains unresolved. I’m extremely frustrated.” However, this doesn’t necessarily reflect a delay in response from the support team. Every service has its share of challenging problems. While the support team seems to engage and attempt to assist, not all issues have straightforward solutions. Furthermore, many of these complaints lack details about the actual problem, making it hard to determine if it’s genuinely an unsolvable situation or a case of incompetence.

- There are also reports of difficulties linking accounts. While support does step in to assist, these challenges are primarily technical in nature, and common to many online businesses. I wouldn’t necessarily attribute this to support incompetence but rather see it as users venting their frustrations.

Hidden fees

Numerous user reviews express frustration over perceived “hidden fees” with Acorns. But in truth, while there are costs involved, there’s no indication of egregiously concealed fees. The real concern seems to be that many users inadvertently sign up for subscriptions, or perhaps they’re aware at first but forget as time goes on. This unintentional commitment can result in unexpected charges. It’s crucial to stay attentive, particularly when considering an upgrade to a paid account.

Cancelling accounts

Many users have reported facing issues when trying to close their Acorns accounts. Common complaints range from enduring persistent monthly subscription charges even after attempting to close the account to facing hurdles in trying to unlink associated bank accounts. Some users claim they’ve made multiple attempts over extended periods without success, with one remarking that the $5 monthly subscription fee appears “immortal.” Another user lamented the need to provide extensive documentation, such as a driver’s license, utility bill, and bank statement, to unlock and eventually close the account – documentation that wasn’t required during the initial sign-up. However, it’s worth noting that sometimes these complaints might stem from individuals who forgot about their subscriptions and, upon realization, sought to rationalize the situation by shifting the blame elsewhere. The cancelation process is pretty simple, here is a step-by-step guide:

- After logging in to your account, tap the menu (avatar) in the upper left corner of the screen

- Tap “Settings”

- Select “My Subscription”

- Tap the individual account(s) that you would like to close (Invest, Later, Checking, or Early)

- Tap “Close account” and the in-app experience will guide you through the process

The primary concern causing quite a stir is the requirement: “You’ll need a verified checking account linked to your Acorns account so that we can transfer your money when closing your account.” However, it’s a necessary step; after all, they need a destination to transfer your funds on account closure. Many complaints regarding account cancellation appear to stem from individuals who face challenges linking a checking account.

Is it safe to invest with Acorns?

Yes, Acorns is a regulated platform overseen by the U.S. SEC and is a member of FINRA. Accounts have SIPC protection up to $500,000. While the platform provides security measures, like any investment, there’s an inherent risk due to market fluctuations.

Alternatives to Consider

Here are some alternatives to Acorns, and reasons why they might be worth your consideration:

1) Betterment: A robo-advisor platform that automatically adjusts your portfolio.

- Pros: Personalized portfolios, tax-efficient investing, educational resources.

- Cons: Annual fee based on assets, no direct stock or cryptocurrency trading.

2) Stash: Tailored investments to your interests with as little as $5, letting you buy fractional shares.

- Pros: Thematic investing options, educational tools, allows weekly or monthly deposits.

- Cons: Monthly fees, less automated than other platforms.

3) Wealthsimple: An automated investing app emphasizing socially responsible investing.

- Pros: Portfolio customization, emphasis on ethical investing, user-friendly design.

- Cons: Higher fees for accounts under $100,000, no direct stock picking.

Conclusion:

Acorns is a commendable app that offers significant features to help users streamline their financial journey. While it has faced its share of negative perceptions, a deeper dive reveals that many of these criticisms are either unfounded or blown out of proportion. For those aiming to kickstart their savings and investment habits, Acorns presents a robust platform worth considering.