If you’re reading this, chances are you’ve heard about Truebill through various channels – be it a friendly tip, an engaging advertisement, or while navigating the maze of financial management tools online. Your interest has likely been piqued by its promises of financial clarity and control, leading you to wonder just how effective Truebill can be in managing your finances. Before we begin, it’s crucial to note that this review for TrueBill (Rocket Money) is unlike the standard ones that mainly list features and excessively praise the application with the ulterior motive of earning from client referrals. On the contrary, this analysis is a genuine attempt to gauge the app’s utility by covering all its aspects, good and bad, informed by hands-on testing of more than 20 similar applications. The observations shared in this article are based on a hands-on experience and a meticulous examination of user feedback, highlighting the common praises and complaints associated with the app. The aim is to provide a well-rounded, informed perspective to help you understand what the application truly offers.

I’m Remus Zoica, the creator of responsiblebudget.org. You might wonder what qualifies me to offer insights on Truebill or any other financial tool. Allow me to share a bit of my background. I hold a bachelor’s degree in Economic Engineering, which has equipped me with an intricate understanding of financial systems and economic complexities. However, my expertise is not just theoretical. Over more than ten years in the field, I’ve faced and untangled the complexities of personal finance firsthand. This blend of academic insights and real-world financial encounters shapes my analysis, ensuring that the reviews I offer are not only informed by expert assessment but also enriched by genuine user experience. Now, with a clear perspective and purpose in mind, let’s dive into the comprehensive review of Truebill.

First, the short version:

The Truebill or Rocket Money app is best for:

- People with terrible spending habits.

- People with ADHD, those who are newly retired, or recently divorced (read further to see why).

- People who know they are impulsive, have a terrible memory, or are forgetful.

The PRO’s for TrueBill or Rocket Money:

- It is intuitive, pretty easy to set up and use

- Exemplary customer support, but only through email

- They give refunds easily, without much hassle

- It helps you identify and cancel other subscriptions

- It has a beautiful user interface

- You get constant reminders and notifications for bills that are due

The CON’s for TrueBill or Rocket Money:

- Bill negotiation is hit or miss; many people complain about this feature

- Many upgrade to the paid version unknowingly or by mistake (and realize this later)

- No phone support

I strongly advise you to read the rest of the article to understand its meaning and if it fits you well. However, if you’re convinced to try the app, remember to be cautious when prompted to upgrade to the paid version, avoid the ‘bill negotiation’ feature, and request a refund if necessary. Then start here.

In the following sections, we’ll delve into the specific features of RocketMoney, focusing on its key offerings like budget tracking, expense management, and subscription cancellation services.

What is TrueBill (Rocket Money)?

TrueBill, now known as Rocket Money, is a user-friendly money management app on Android and Apple devices. The name change occurred after Rocket Companies acquired TrueBill. The app shows you all your monthly subscriptions, so you can easily cancel the ones you don’t want. It also tracks your bills, determines if they can be made lower, and negotiates better rates. Additionally, it helps you control your spending, automatically save money, and avoid paying for things you don’t use. Although some basic features are free, you’ll need to pay for premium ones like bill negotiation and more personalized budgeting. There’s also a handy service starting at $3/month that cancels unwanted subscriptions for you.

TrueBill, now known as Rocket Money, is a user-friendly money management app on Android and Apple devices. The name change occurred after Rocket Companies acquired TrueBill. The app shows you all your monthly subscriptions, so you can easily cancel the ones you don’t want. It also tracks your bills, determines if they can be made lower, and negotiates better rates. Additionally, it helps you control your spending, automatically save money, and avoid paying for things you don’t use. Although some basic features are free, you’ll need to pay for premium ones like bill negotiation and more personalized budgeting. There’s also a handy service starting at $3/month that cancels unwanted subscriptions for you.

Why did TrueBill change to Rocket Money?

The TrueBill acquisition by Rocket Companies in December 2021 led to a name change in August 2022, transforming TrueBill into Rocket Money. This move made the app a part of Rocket Companies’ more extensive portfolio of financial services, which includes Rocket Loans, Rocket Mortgage, and LowerMyBills.com. Haroon Mokhtarzada, the CEO of TrueBill, noted that since its inception in 2015, the app had grown from merely a bill and subscription management tool to a comprehensive financial resource providing budgeting, smart savings, and credit monitoring. The integration into Rocket Companies and the subsequent name change to Rocket Money not only broadened the scope of services available through the Rocket platform, encompassing more than just expense tracking and subscription cancellations but also extending to savings, credit access, home buying, and more. Therefore, the answer to ‘why did TrueBill change to Rocket Money’ and ‘what happened to TrueBill’ lies in the expansion of services and the alignment with the broader mission of Rocket Companies to assist people in all areas of their finances.

The TrueBill acquisition by Rocket Companies in December 2021 led to a name change in August 2022, transforming TrueBill into Rocket Money. This move made the app a part of Rocket Companies’ more extensive portfolio of financial services, which includes Rocket Loans, Rocket Mortgage, and LowerMyBills.com. Haroon Mokhtarzada, the CEO of TrueBill, noted that since its inception in 2015, the app had grown from merely a bill and subscription management tool to a comprehensive financial resource providing budgeting, smart savings, and credit monitoring. The integration into Rocket Companies and the subsequent name change to Rocket Money not only broadened the scope of services available through the Rocket platform, encompassing more than just expense tracking and subscription cancellations but also extending to savings, credit access, home buying, and more. Therefore, the answer to ‘why did TrueBill change to Rocket Money’ and ‘what happened to TrueBill’ lies in the expansion of services and the alignment with the broader mission of Rocket Companies to assist people in all areas of their finances.

Is Rocket Money Safe & Secure?

Being cautious is crucial, especially when a financial app requests access to your personal online financial records. It’s natural to be skeptical and view such requests as red flags. Proceeding with caution is always advised. That being said, Rocket Money is considered secure as it employs 256-bit encryption to store data and partners with Plaid to link your accounts securely. This means Rocket Money cannot change your accounts, and you can unlink accounts if you wish. Additionally, Rocket Money does not sell your data to third parties and hosts its data on Amazon Web Services, which is trusted to store sensitive data for organizations like the U.S. Department of Defense. So, while Rocket Money’s safety measures appear to be on par with current industry security standards, it is ultimately up to the individual user to decide if these measures are sufficient to trust Rocket Money with their data.

Is Rocket Money Trustworthy?

For a financial app like Rocket Money to be considered trustworthy, it should meet several criteria:

- Data Security

- Privacy

- Functionality

- Customer Support

- Transparency

- Reputation

While the first four categories have no issues at all, minor issues and inconsistencies exist in the last two. Though not significant, these concerns are worth paying attention to and will be discussed in more detail later on. Despite these minor issues, I would lean more towards classifying the app as trustworthy rather than untrustworthy.

How does Rocket Money Work?

Rocket Money works like a buddy who’s super good with finances. You download the app and connect your bank and cards.

Rocket Money works like a buddy who’s super good with finances. You download the app and connect your bank and cards.

Once you’re set, it’s like looking at your wallet and seeing where your cash is going. It puts all the subscriptions you’ve got in one spot – Netflix, gym, magazines, whatever – so if you spot something you forgot about, you can ditch it. They’ll even handle the breakup if you upgrade to their fancy version!

It also gives you a lowdown on your spending versus what you’re making. Plus, it’ll give you a nudge if you’re about to get hit with a hefty bill or if your account’s looking a bit slim.

It also has this excellent savings bit where it can put aside a bit of money here and there for you. You’re in the driver’s seat, deciding how much and when.

You can also peek at your credit score, see how you’re doing, and if anything fishy’s going on. And for the cherry on top, it helps you set a spending plan – like how much you wanna spend on fun stuff, food, or gas. It’ll even warn you if you’re splurging too much.

You can also peek at your credit score, see how you’re doing, and if anything fishy’s going on. And for the cherry on top, it helps you set a spending plan – like how much you wanna spend on fun stuff, food, or gas. It’ll even warn you if you’re splurging too much.

It can haggle your bills down for you. Imagine arguing with your phone company to get you a better deal. They take a piece of the pie if it saves you some cash. However, I wouldn’t recommend using this feature yet. I’ll explain why down below.

So, if you’re trying to be more on top of your money game, Rocket Money’s like that wise friend who always has good advice.

What makes Rocket Money stand apart from other apps?

-

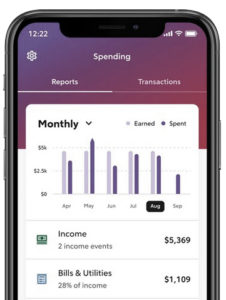

- The Rocket Money App is intuitive & easy to use. After giving the app a hands-on test, I can say it’s straightforward and intuitive. And you know what’s cool? I’m not the only one who thinks so. I dug through hundreds of reviews, and many folks kept mentioning how simple it was to set up and use. A lot of regular users find it user-friendly. But what does this mean? Imagine you’ve got this shiny new gadget or app, right? Now, if you can pick it up and know instantly how to use it without scratching your head or needing a manual, that means it’s intuitive. When you hop into a new car, everything feels right where it should be. So, when a financial app is intuitive, it’s super user-friendly and straightforward. Now, why’s that so important? Well, money stuff can be super confusing on its own. So, the last thing you want is to fight with an app that’s making it even harder. An intuitive app makes your life easier. It helps you get what you need done without the fuss so that you can get on with the fun stuff. No one wants to waste time figuring out where everything is, right? An intuitive app gets out of your way and lets you do your thing. And hey, don’t just take my word for it – you can see a sneak peek of its user-friendliness in the screenshots I’ve posted in the section above.

- Rocket Money has a beautiful interface. So imagine this: when you open up a financial app that looks good, it’s like stepping into your favorite cafe. It’s inviting, right? You’d want to sit down, take time, and maybe return the next day. It’s the same thing with an app. If it looks sleek and pretty, folks are naturally more drawn to keep opening it up and using it. And when we’re talking about managing money, which can be a headache for many, having an app that’s a joy to look at makes the process way less daunting. The more people enjoy the experience, the more likely they’ll keep up with their finances by consistently using the app. That’s the magic of a beautiful interface.

- It has exemplary customer support through email. This means that they respond quickly, are super friendly, and, most importantly, know their stuff. You don’t have to wait for ages, and when you get a reply, it’s clear and helps solve your problem. I wanted to ensure I wasn’t just the lucky one getting all this promising treatment. So, I did a bit of digging. I reviewed many reviews from other folks to see if they got the same top-notch service. Guess what? It wasn’t just me! Loads of people are singing the same tune about their experience. So, it’s safe to say it’s not just a one-off thing; they’re genuinely on the ball. However, there were also many unresolved issues, mainly about bill negotiation. I will delve into this aspect when discussing the disadvantages of using the app or its weak points. But what’s commendable is that the support team was right there, even responding on the review sites. They weren’t just turning a blind eye; they genuinely tried to address the concerns. But if you prefer not to use email for communication and need to do it over the phone, remember that this feature isn’t an option.

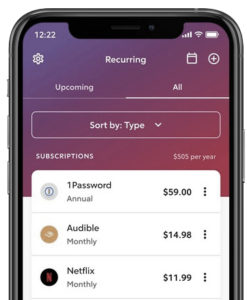

- Rocket Money helps us spot and cancel unwanted subscriptions. When I connected my bank and credit card details, it rummaged through and pulled up a list of all my subscriptions. I didn’t even realize I was still paying for some of them! We all tend to forget those monthly charges or free trials turned into paid services. Rocket Money helps shine a light on those so you can decide if you need them or if it’s time to let them go and save some cash. You know, it’s kind of disappointing that our usual banking apps don’t highlight these subscription charges for us. When your account is buzzing with daily transactions, it’s like trying to find a needle in a haystack to spot those sneaky subscriptions. Having them stand out is crucial so you can take a moment and think, “Do I even use this anymore?” That way, you’re not just mindlessly letting your money slip away.

- You get constant reminders and notifications for bills that are due. Have you ever had one of those days when everything’s just a blur, and then, out of nowhere, you suddenly remember that bill you forgot to pay? Happens to the best of us. Getting those little nudges and reminders for upcoming bills is a game-changer. It’s like having a buddy tap you on the shoulder, saying, “Hey, don’t forget about this!” Without those notifications, it’s so easy to lose track and then bam – late fees or, even worse, a hit on your credit score. Getting those constant heads-ups? That’s a lifesaver. It keeps everything smooth and stress-free. You know, for folks like those with ADHD, where the brain’s jumping from one thing to the next, or someone who’s newly retired and suddenly adjusting to a whole different routine, these reminders are a godsend. And let’s not forget someone who’s recently gone through a divorce. Their world’s been turned upside down, and tracking bills might be the last thing on their mind. Those who are just swamped with life and have too much on their plate can miss these details. These reminders are like a gentle tap saying, “Hey, I’ve got your back. Don’t forget this.” It’s about having that extra help when life gets chaotic, making sure the bills don’t slip through the cracks.

- They seem to be giving refunds easily, without much hassle. There’s this story floating around in the reviews where someone mistakenly paid for a whole year. They reached out to support, and boom, without a lot of back-and-forth, they got their refund. Seems like they genuinely care about their users. This kind of smooth refund process isn’t something you see often on review sites. Many apps make getting a refund an absolute nightmare, probably hoping to discourage folks from trying. But with Rocket Money, it doesn’t seem to be that way. They seem to be on the user’s side, which is refreshing! While scrolling through reviews, I encountered at least five instances where folks mentioned similar smooth refund experiences. However, it’s a tad concerning that quite a few people seem to upgrade to the paid version mistakenly. Still, it’s good to know that Rocket Money isn’t making it a pain to get your money back.

- It helps you identify bad spending habits. If you’ve ever felt lost about where your money’s going, this app is your roadmap. Not only does it break things down week by week, but it also gives a clear picture of where every dime is spent. It is super helpful for folks like me with, let’s say, less-than-stellar spending habits. Plus, seeing all your cash flows laid out? Total eye-opener. Trust me, it’s a lifesaver for getting a grip on your finances.

Lowering your bills

One of the standout features of Rocket Money, which deserves a deeper dive, is its potential to lower your bills. This aspect of the app is particularly appealing to those who feel overwhelmed by their monthly expenses. The app analyzes your recurring payments and identifies opportunities where you might be overpaying. This could be anything from your electricity bill to your gym membership. The idea is that by negotiating better rates or eliminating unnecessary services, you can free up more of your income for savings or other financial goals.

However, as mentioned earlier, the bill negotiation feature has its drawbacks. It’s essential to approach this feature with a clear understanding of its workings. Remember, Rocket Money takes a percentage of the annual savings as a fee, which can be substantial depending on the amount saved. Therefore, while the potential for lowering bills is a significant advantage, it’s crucial to weigh the immediate cost against the long-term savings. This feature best suits those comfortable with the terms and confident in the potential savings outweighing the upfront fee.

Managing Subscriptions

Another critical feature of Rocket Money is its ability to manage subscriptions. In today’s digital age, where subscription-based services are ubiquitous, it’s easy to lose track of what you’re signed up for. Rocket Money highlights these recurring charges, helping you identify and cancel subscriptions you no longer need or use. This feature is handy for subscribing to multiple streaming services, online magazines, or other digital platforms.

The app’s user-friendly interface makes it simple to review all your subscriptions in one place. This clarity can lead to significant savings, as many people are unaware of how much they spend on rarely used subscriptions. By trimming these unnecessary expenses, Rocket Money helps streamline your finances, allowing you to allocate resources more effectively.

In conclusion, while Rocket Money has its limitations, particularly in its bill negotiation feature, its strengths in lowering bills and managing subscriptions make it a valuable tool for those looking to gain better control over their finances. As with any financial tool, it’s essential to use it to align with your financial goals and circumstances.

Rocket Money cost & fees

When delving into Rocket Money, one of the most perplexing aspects is the opacity surrounding its fee structure. This lack of transparency is not just a minor inconvenience but a significant concern for users turning to the app for better financial management. On the surface, Rocket Money offers a range of appealing features, some of which are available at no cost. However, the journey from a free to a premium user is where things get murky. The app’s premium services, which include enhanced features like bill negotiation, subscription cancellation, and automated savings, come with a monthly fee ranging from $3 to $12. But here’s the catch: the app doesn’t make it easy to find this information upfront.

The difficulty in finding clear information about Rocket Money’s pricing on their website, coupled with the reports of users unknowingly being upgraded to paid versions, paints a concerning picture. It suggests a possible strategy of obfuscation, where users are nudged towards premium services without a transparent acknowledgment of the costs involved.

After going through everything Rocket Money has to offer, I’ve realized that, even though it has some handy features for managing money, it handles user upgrades, and fee transparency could be a lot better. It feels like you’ve got to be extra careful and aware when you’re using the app just to ensure you don’t run into any surprises with fees or unexpected upgrades.

What’s bad about Rocket Money? What are the Concerns and Risks?

Of course, I’ve laid out all the shiny bits about this app, but to give a complete picture, we’ve gotta dive into the not-so-great parts, too. Every story has got two sides, right? Alright, buckle up! Let’s dive into the bad and the ugly side of TrueBill / Rocket Money.

-

- Bill negotiation is hit-and-miss. I wouldn’t advise you to use it yet. Give it at least a few years until this type of service is mature enough; it is in its infancy right now. It’s worth mentioning that many complaints about this app focus on this specific service. There are many of them, so it’s not just a tiny issue. It works like this: the Rocket Money app looks over your bills to spot any possible savings. Then, their team can reach out to those companies and try to get you a better deal. What’s the problem? First, many folks who use this feature don’t realize they have to part with a chunk of the money they save as a fee for the service. Rocket Money takes anywhere from 30% to 60% of the yearly savings and charges it all at once to your card. When we’re talking about more significant amounts of savings, this upfront fee can feel pretty hefty. So, while it might help in the long run, it can pinch your pocket in the short term. Adding to that, you can probably guess the other headaches that can arise. Let’s say a company you’re subscribed to decides to change its pricing next year or throws in some new terms. With bill negotiation, misunderstandings can quickly happen. Maybe you already had a special subscription rate and might lose that sweet deal. There are just so many ways this can take a wrong turn. And you know what? The number of complaints Rocket Money gets about this feature speaks volumes. It’s clear there are some kinks they need to work out. And it makes sense when you think about it. The bill negotiation service is only as good as the negotiating person. While one person might have the knack for getting fantastic deals and understands the ins and outs of the process, another might just be trying to close the deal quickly without digging deep. The varying levels of expertise and dedication among negotiators can lead to wildly different outcomes for users. So, while some folks might rave about their savings, others might wonder if they drew the short straw. If I were giving advice, I’d suggest steering clear of this bill negotiation feature, at least until around 2025. By then, the company will hopefully have had enough time to iron out the kinks and refine the service. It’s always good to give new features time to mature and develop. And who knows? In a few years, it might be their standout feature! Until then, it might be best to play it safe and avoid potential headaches.

- Many users unknowingly or by mistake upgrade to the paid version (and realize this later). From what I’ve gleaned from user reviews, many users have unexpectedly upgraded to the premium version. They’re getting nudged up a tier without catching that moment. It could be that the wording isn’t crystal clear, or something else is catching their eye and distracting them. If you dive into the app, just be vigilant and ensure you’re only signed up for what you truly want. If they weren’t giving out fast and hassle-free refunds, I’d be shouting about this from the rooftops. But the way it’s going, it’s almost like they’re doing the very thing they’re trying to prevent: having folks shell out for something they’re not using. It’s a bit ironic.

- No phone support. Email support doesn’t cut it for everyone, no matter how stellar it is. Imagine being in a tight spot financially (like a single mom who paid for a one-year subscription without realizing it, and you need the money fast), then all you want is a real person on the other end of the line to say, “Hey, I got you.” In those heart-dropping moments, you don’t want to type up an email and wait, right? You want immediate answers. It’s about peace of mind. So, no phone support can be a real bummer, especially for a financial app where high stakes and time often matters. This is especially true for the bill negotiation service. For example, imagine if they negotiate a new rate for your cable bill, but it drops a crucial channel you watch. You’d want to address that immediately, not wait for an email response that might take hours or even a day.

- There were some complaints related to cancellations, but they seem to be fixed. I’ve gathered that those complaints were about the old TrueBill app. But they’ve ironed out those kinks since they switched things up to Rocket Money. This is not a huge deal, but you should know about it.

- A few users preferred the old TrueBill over the new Rocket Money app. But honestly, those voices are drowned out. Way more people are giving thumbs up to the new app than the old one.

Is rocket money available globally?

No. Rocket Money does not extend its services to international financial institutions. Just a heads up if you’re thinking about using Rocket Money – it’s great for local use, but it doesn’t play well with banks outside the U.S. So if you’ve got accounts in places like Canada, Mexico, Australia, or Europe, you won’t be able to link them up with this app.

Long-term use, app updates & improvements

I did some digging to find out about the long-term updates for the Rocket Money app, and honestly, it was a bit surprising. There’s not much out there about their update history, and what’s more, they don’t seem to have a clear roadmap for future updates. This lack of a roadmap means we’re in the dark about what new features or improvements might be coming down the line. Honestly, I think Rocket Money really needs to step up their game here. Not having a clear roadmap makes it tough for us users to know what’s coming next. It would be so much better if they were open about their plans. That way, we’d feel more in the loop and confident about using the app for our financial needs. It’s all about trust, right? If they showed us where they’re headed, it would make a huge difference in how secure and informed we feel while using their app.

Rocket Money alternatives

Exploring alternatives to Rocket Money is essential in the quest for financial management tools, especially considering the challenges some users face with its fee structure and bill negotiation feature. Here, we delve into a few noteworthy alternatives, highlighting what makes them stand out in the crowded financial app marketplace.

1. Mint: The All-Encompassing Budget Tracker

Why It Stands Out: Mint, a long-standing player in the financial app world, offers comprehensive budgeting tools and real-time tracking of your finances. Its standout feature is the ability to categorize transactions automatically, providing a clear picture of where your money is going. Unlike Rocket Money, Mint is free, making it an attractive option for those wary of hidden fees or unintentional upgrades to premium services.

2. YNAB (You Need A Budget): The Proactive Budget Planner

Why It Stands Out: YNAB‘s philosophy centers on giving every dollar a job, encouraging proactive budgeting rather than just tracking expenses. This approach helps users actively manage their money and plan for future expenses. While YNAB is a paid service, its pricing is transparent, and it offers a 34-day free trial, allowing users to fully understand the app before committing financially.

3. Trim: The Automated Financial Assistant

Trim enters the financial app arena as a robust contender, particularly for those seeking an automated assistant to manage their finances. Similar to Rocket Money, Trim offers a range of services aimed at optimizing your financial health, but with its unique twists and capabilities.

4. Simplifi: More intuitive but less comprehensive

Simplifi offers a more intuitive and user-friendly interface compared to Rocket Money, but Rocket Money excels in providing more comprehensive features for expense tracking and subscription management.

5. Empower: for more banking and savings focus

Empower leans more towards banking and savings, whereas RocketMoney centers more on subscription management and budget tracking. For individuals seeking an all-in-one banking solution that offers interest-bearing accounts and tools to enhance savings, Empower stands out as a good alternative.

6. Kubera for Wealth, RocketMoney for Daily Finances

Kubera is more about wealth tracking and the bigger picture of one’s financial health, while RocketMoney is about managing and optimizing day-to-day expenses and subscriptions. For someone interested in detailed wealth portfolio management, Kubera would be the better choice, whereas for those looking to control their monthly expenses and manage subscriptions, RocketMoney would be more beneficial.

7. Acorns: Revolutionizing Micro-Investing

In my Acorns micro investing review, I discovered that while Acorns and Rocket Money serve different personal finance needs, they share similarities. Both apps provide a user-friendly interface and automated financial management tools, emphasizing a mobile-first approach for ease of use. Acorns, however, extends its offerings beyond mere expense tracking, delving into the realm of micro-investing. This feature enables users to invest spare change by rounding up purchases, making it an ideal platform for those new to investing.

Each of these alternatives to Rocket Money has its unique strengths, catering to different needs and preferences in financial management. Whether you prioritize comprehensive budgeting, investment tracking, simplicity, or collaborative financial planning, an app can meet your needs. The key is to choose an app whose features align with your financial goals and whose fee structure and transparency match your comfort level.

Final thoughts

Considering whether Rocket Money is the right financial management tool for you, it’s important to weigh its strengths and weaknesses. Here, I’ve compiled a list of pros and cons:

Pros:

- Intuitive and User-Friendly: Rocket Money is easy to set up and use.

- Customer Support: Offers exemplary customer support, albeit only through email.

- Refund Policy: They provide easy, hassle-free refunds.

- Subscription Management: Helps in identifying and cancelling other subscriptions effectively.

- User Interface: The app has a beautiful user interface.

- Reminders and Notifications: Constant reminders and notifications for upcoming bills.

Cons:

- Inconsistent Bill Negotiation: The bill negotiation feature is hit or miss, with many users expressing dissatisfaction.

- Unintended Upgrades to Paid Version: Users often unknowingly upgrade to the paid version, realizing it later.

- Lack of Phone Support: The app does not offer phone support, which might be inconvenient for some users.

We’ve delved into the features, user experiences, and reviews surrounding TrueBill and its successor, Rocket Money. Rocket Money might be worth a test run if the advantages align more with your needs than the disadvantages. Start with the free version, and tread cautiously when considering an upgrade to premium. Financial tools are deeply personal, so always ensure they match your requirements before diving in!