Even if the question seems more complex, there is a simple and straightforward answer based on a study conducted by the Bureau of Labor Statistics in 2020, in which they extracted the average annual expenditures for all consumer units and divided them into 14 categories. Out of these, we’re only going to talk about the six most important ones: housing, transportation, food, personal insurance and pensions, healthcare, and apparel/services. We will ignore categories or subcategories like alcoholic beverages, tobacco products, or smoking supplies; although they make up an interesting read, they’re not relevant to the subject of typical expenses in a budget plan. If you’re curious, click the link above and review them.

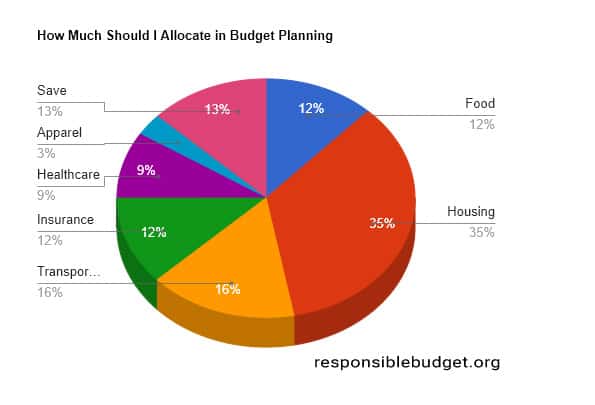

If you want to start budget planning and you are not sure how much you should allocate in each category, here is an example of what the average American allocates (in rounded numbers):

- 12% for food

- 35% for housing expenses

- 16% for transportation

- 12% for insurance and pensions

- 9% for healthcare

- 3% for apparel and services

Here is a pie chart so you can visualize the numbers better:

Once you’ve allocated your budget, you’ll find that about 13% of your income remains freely available. This amount can be used for diverse purposes, such as paying off debt, saving, donating, or simply enjoying yourself. This budgeting model is particularly beneficial for those new to financial planning, providing a starting point to distribute their budget. You might find opportunities to economize, like reducing housing costs or efficiently managing food expenses if you’re a skilled cook. The key is to start planning your budget and stay committed to it, adapting as needed to fit your unique financial situation.

Let’s explore each spending category in greater detail, delving into specifics to understand better how to manage and allocate funds effectively in each area.

How much should you spend on food or groceries per month?

How much should you spend on rent/housing per month?

How much should you spend on car payments/transportation per month?

How much should you spend on personal insurance and pensions per month?

How much should you spend on healthcare each month?

How much should you spend on apparel and services each month?

How much should you spend on food or groceries per month?

You should allocate 11.9% of your monthly income for food or groceries. This is the value that the average American allocates for food, but it can vary based on your specific circumstances. Married couples usually allocate a bit less, at around 11.2% of their income. And then the percentage increases slightly to 12.5 for married couples with children under 18. If you are single, you might get away with less, namely 11.5% of your income. Of course, these numbers are just an average, and your specific circumstances are the ones that matter most. For example, you could be a skilled cook and use all the food you buy without wasting anything. You’ll surely get away with less in this case. In other words, these numbers are helpful for people who want to use a budget planner but have no idea how much money to allot for food. They can start with an average and adjust over the following months after some contact with reality.

How much should you spend on rent/housing per month?

You should allocate 34.9% of your income for housing expenses. According to the Bureau of Labor Statistics, this is the value the average household allocates for spending related to housing. What is strange about this number is that it is higher for singles, peaking at 38.5%. And it is less for married couples, who spend only 32.7% of their income. Conversely, married couples with children under 18 spend even less: 32.4%. I’m not sure why, but these are the numbers published by the Bureau of Labor Statistics. I tried to explain these findings in a few ways but was unsatisfied with the answers. However, if you are new to budget planning and don’t know where to start, allocating 35% of your income to rent or housing should be a good start. This number should be a good starting point before looking for rentals so you don’t overspend.

How much should you spend on car payments/transportation per month?

You should allocate 16% of your monthly income for transportation-related expenses. This number does not vary much; for example, it’s just a bit less: 15% for married couples. I think this happens because at least sometimes the couple will travel together. But it increases for married couples with children under 18 years old to 17.4% due to the extra spending required to transport the children. According to the Bureau of Labor Statistics, these are the average percentage of the income allocated by Americans for transportation. It’s an excellent place to start if you are unsure how much to allocate, and in the following months, you can adjust it according to your specific needs. If you are not American, these numbers might not suit you. For example, a lot of European countries rely heavily on public transport. And the numbers will be different there.

How much should you spend on personal insurance and pensions per month?

You should allocate 11.8% of your monthly income for insurance and pensions. If you are single, you might get away with less, namely 10.1%. The numbers increase drastically for married couples with children under 18 years old, namely 14%. And that’s not surprising because insurance is more valuable and necessary in those cases. This is the category that many people will probably skip at the beginning of their journey toward financial growth, especially if they’re not earning enough.

How much should you spend on healthcare each month?

You should allocate 8.4% of your monthly income for healthcare each month. According to the Bureau of Labor Statistics, this is the average value Americans put aside out of their income each month for healthcare. This number is the lowest for singles, at 7.8%, and increases to 10.8% for married couples.

How much should you spend on apparel and services each month?

You should allocate 2.3% of your monthly income for apparel and services. This category had the most significant decline in spending after the pandemic started. This means that people look here first to increase their savings. Another thing worth mentioning is that footwear was one of the items with the most significant drop. A budget plan is like a new outfit. It’s great to wear around, and I hope people notice you. But if you want to be complimented, you have to keep revising and improving it constantly.

In summary, this article does more than just present figures; it offers a comprehensive framework for intelligent financial planning, promoting an engaged and hands-on approach to managing personal finances. This proactive stance enables individuals to navigate their financial paths with greater assurance and transforms their budget into an effective instrument for addressing immediate needs and achieving long-term goals. Incorporating tools like the Rocket Money app can significantly enhance this experience. A hands-on review of the Rocket Money app reveals its effectiveness in tracking expenditures, identifying potential savings, and refining financial strategies, making it best for those seeking an interactive and user-friendly budgeting tool. Additionally, a review of Acorns highlights its unique approach to micro-investing, further enriching the personal finance journey. By integrating these digital solutions, budgeting becomes not just a routine task but a dynamic and empowering step toward financial independence and prosperity.