If you’re reading this, you might need help managing your money. Thanks to student loan debt, credit card bills, and subpar salaries, living costs continue to rise while incomes remain stagnant. Even with a budget in place, most Americans struggle to keep track of their spending and end up spending more than they have on a regular basis. If you’re committed to changing your spending habits and becoming financially independent, you need an effective tool that can help you track your expenses and stay on budget at all times.

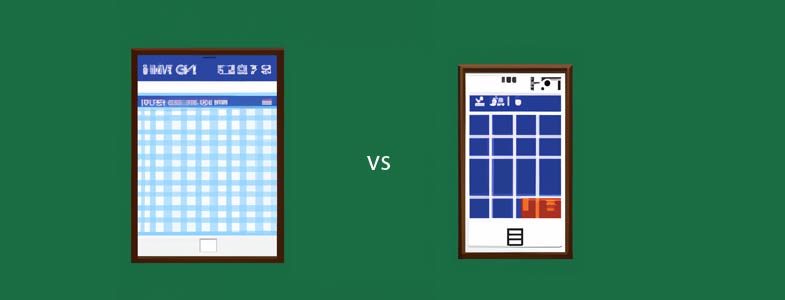

While many people use spreadsheets for their convenience and ease of use, there are several pros and cons between using an app vs. a spreadsheet when it comes to budgeting. Here’s a detailed look at both options, emphasizing how they can help you save more money in the long run.

| Budgeting App Pros | Spreadsheet Pros |

| They are easier to use | They don’t distract |

| They can sync automatically | Build your own reports |

| More features like goals, reminders | They are free to use |

| Easier to access on the spot | You can store them locally |

| Budgeting App Cons | Spreadsheet Cons |

| More expensive | Learn / Know spreadsheet formulas |

| It’s hard to find one that suits your needs | Manually enter values |

| Might have a lot of distracting features | Not easily accessible on the phone |

| Might change in time | Summary graphs are hard to build |

And now, let’s dive deeper into each budgeting app vs. spreadsheet pros and cons!

Budgeting App Pros

- They are easier to use. Some people find budgeting apps easier to use than spreadsheets because they provide a more user-friendly interface and don’t require as much financial knowledge. But there is no app that is best for everybody. The disadvantage is the fact that you have to try many until you find a developer who sees finances in the same way you do. If you are willing to put up with the research process, you might find some gems that you might use for the rest of your life.

- They can automatically sync with bank accounts. Budgeting apps typically use a technique called “screen scraping” to automatically sync with bank accounts. This means the app logs in to the user’s bank account and retrieves account information directly from the bank’s website. The app then parses this data and uses it to populate the user’s budget. There are a few advantages to this approach. First, it is relatively simple to implement. Second, it does not require the user to enter any data manually – the app can just retrieve it automatically from the bank. Finally, it is relatively secure since the user’s bank login information is never stored on the budgeting app’s servers.

- More features like goals and reminders. You can also set up alerts or notifications to remind you to transfer money into your savings account when you have reached a certain spending limit. But one of the most important features of budgeting apps, compared to spreadsheets, is the option to automatically deduct a certain amount of money from your paycheck and deposit it into your savings account.

- Easier to access on the spot. Like any other mobile app, budgeting apps can be used anywhere. They are especially convenient for people who are always on the go and need to access their information quickly and easily. However, some mobile apps require an Internet connection to function properly.

Budgeting Apps Cons

- More expensive. Even though there are free budgeting apps, you might have to pay a small sum of money most of the time to access the really useful features. Budgeting apps vary in price, some have monthly or annual subscription fees, but these are typically very reasonable. Budgeting apps are affordable, but we now compare them with free spreadsheets (using Google Sheets). So, if you are unwilling to spend a dime, you might have difficulty using most of them.

- It’s hard to find one that suits your needs. Finding a good budgeting app can be difficult because so many options are available. It is important to find an app that is easy to use and understand, as well as one that offers features that are relevant to your needs. Various budgeting apps cater to different audiences, so it is important to do some research to find the right one for you.

- Might have a lot of distracting features. There can be a number of things that can be distracting when using budget apps. This can include things like ads, notifications, or even the app’s design. One of the most important things that can be distracting is if an app is constantly sending notifications. This can be annoying, and in many cases, it might be complicated to adjust those notifications to the level you would find them useful and not distracting. So, prepare to spend some time on this if you are easily distracted and want to use a budgeting app.

- Might change in time (requires accommodation). Anything can happen in time. The app developer might sell the platform to somebody who can adjust it to their will. And the beloved app might change to something you hate in no time. This has happened a few times and will probably happen in the future. In this case, the only thing you can do is search for another app. When compared to spreadsheets, they will probably stay the same. They might have some extra features, but the basics will probably be there for a long time.

Spreadsheet Pros

Spreadsheet Pros

- They don’t distract. Spreadsheets don’t have notifications or ads; they don’t say anything to the user. They just calculate based on the formulas you set up. They don’t have to be constantly updated. I even had to update my phone at one point because it was too old and could not install the app I needed. You don’t have to deal with anything like this when you’re working with spreadsheets. They can function on any PC, Mac, or mobile device.

- They can be customized to your liking (build your own reports). You can customize the appearance and layout of your spreadsheet reports to suit your needs better. You will be able to do this to a certain extent in budgeting apps as well, but there, you are way more limited – especially by the vision of the budgeting app developer. You can adjust the column widths, font size, and the number of decimal places displayed. You can also add or remove columns and rearrange the order in which columns appear. You can also add filters to your report to include only specific data. It certainly will take a lot of work, but in the end, you can get exactly what you want or need.

- They are free to use. Using spreadsheets in Google Sheets is absolutely free. You can create and edit spreadsheets with it and share them with others. There are no limits on the number of sheets you can create, edit, or use offline. But this won’t be the case if you particularly want to use Excel from Microsoft Office. Excel is a paid program in the Microsoft Office productivity software suite. You won’t have this advantage if you get used to it and specifically need it. Anyway, I recommend you try Google Sheets; give it a chance, and it might grow on you!

- You can store them locally. There are pros and cons to storing information in the cloud vs. locally on a device. One key advantage of storing data in the cloud is that it can be accessed from anywhere, as long as there is an internet connection. This is opposed to locally stored data, which can only be accessed from the specific device it is stored on. However, there are also some disadvantages to storing data in the cloud. One key concern is security – with data stored remotely, it is more vulnerable to hacking and cyberattacks. Another issue is reliability – you cannot access your data if the internet connection is down.

Spreadsheet Cons

- You need to know some formulas / basic spreadsheet usage – Formulas can be one of the most challenging aspects of using a spreadsheet program. While many resources are available to help users learn formulas, it can still be difficult. But it depends on many factors, such as your prior experience with computers and other software, your natural aptitude for learning new things, and the specific formulas you need to learn. However, if you are willing to spend time and effort learning, you can pick up most spreadsheet formulas relatively easily. But this won’t be easy for most people. If you have some background in using them, then this problem will be minor.

- You need to enter values manually. Manually entering transaction details is less accurate, as it relies on users remembering to input every purchase they make. However, it can still be a helpful way to keep track of spending, especially if budgeting is more of a casual endeavor. However, you should know that this can be done automatically, at least to a level where you spend significantly less time on this task. If you are diligent, don’t lose focus easily, and are not scared by numbers, this won’t be a major problem for you, but it might be for many people.

- Not easily accessible on the phone. While using a spreadsheet on a mobile phone is possible, it is not always the easiest thing to do. The small screen size can make it difficult to see all of the information at once, and entering data can be cumbersome on a touch screen. For these reasons, using a spreadsheet on a larger device, such as a laptop or desktop computer, is often better. And if you need to adjust your spending or plan often, a budgeting app might be a better choice.

- Summary graphs are hard to build. Creating data visualizations in a spreadsheet can be challenging, depending on the data set and the desired visualization. To create a basic visualization, such as a bar or line graph, you must enter the data into the spreadsheet and then use the built-in charting tools to create the visualization. If you want to create a more complex visualization, such as a scatter plot or heat map, you may need to use a third-party plugin or add-on. So, it will be complicated if you want to visualize data in special ways. I think it’s better to choose a budgeting app for this. Just check their reporting features and select one with all the reports and visualization options you need.

Final words:

In conclusion, whether you choose budgeting apps or spreadsheets, finding a tool that aligns with your financial habits and goals is key. My review of Truebill has shown that it can be trusted to manage subscriptions and track expenses efficiently. With its spare change roundups, the Acorns app offers an innovative approach for those interested in investment, as highlighted in my Acorns spare change review. Choosing between apps and spreadsheets depends on your preference for convenience and detail and how you plan to integrate these tools into your financial strategy. I hope this analysis will nudge you in the right direction when using a budgeting app or spreadsheet. Even though I prefer budgeting apps, I know there are people out there (even families) who would feel way more comfortable with a spreadsheet.