Keeping track of your money can be challenging, especially if you’re dealing with a variable income, unexpected expenses, and bills that come due on a regular basis. It’s easy to get caught up in the day-to-day grind and not realize until later that you spent more than expected or are coming up short in preparation for an upcoming event like a vacation or car purchase. That’s where budgeting apps can help. These apps make it easier to keep track of your money by presenting all your financial information in one place, helping you identify areas for improvement and set new goals for future savings. With the help of these apps, you might be able to save more money, pay off debt faster, and plan for future expenses.

What can these budgeting apps do to help you save money?

Budgeting apps can help you save money in a number of ways. First, they can help you track your spending so that you can see where your money is going. This can help you identify areas where you may be spending too much money and make adjustments accordingly. Second, budgeting apps can help you set up a budget and stick to it. This can help you ensure that you are not spending more money than you can afford to and help you reach your financial goals. Finally, others may offer features like cash-back rewards or coupons. Many budgeting apps also offer features like notifications or alerts that can help you stay aware of your spending and make sure that you do not go over budget. Let’s take some concrete examples:

How to save money with YNAB?

YNAB is a software program that you can use on your computer or phone, and it is also available as a mobile phone app. The app gives you the ability to track your spending, set goals, and see where your money is going. It also offers tips and advice on how to save money and get out of debt.

YNAB is a software program that you can use on your computer or phone, and it is also available as a mobile phone app. The app gives you the ability to track your spending, set goals, and see where your money is going. It also offers tips and advice on how to save money and get out of debt.

One way to save money with YNAB is to use the “envelope” system. This system assigns every dollar you have to a specific category, like rent, groceries, or entertainment. Once you’ve assigned all of your dollars, you can only spend what’s in each envelope. This system forces you to think about your spending and makes it easy to see where your money is going each month.

Another way to save money with YNAB is to create a monthly budget. This budget should include all of your income and expenses for the month. Once you know how much money you have coming in and going out each month, you can make adjustments to ensure that you’re saving money. For example, if you see that you’re spending too much money on eating out, you can cut back and save that money instead. YNAB can also help you to track your progress in terms of saving money and reaching your financial goals. This can help you to stay motivated and on track, and can also help you to spot any potential problems or areas where you may need to make adjustments.

How to save money with Albert App?

Simply download the app and create an account. Once you’re logged in, you’ll be able to add your bank account and start tracking your spending. You can also set up goals and see your progress over time. It also has a feature that allows you to set up a savings goal and automatically transfer money into your savings account each month. Another way in which this app can help you to save money is by finding discounts and coupons for the things you want to buy before you buy them. The Albert app offers some great discounts on a variety of products and services. You can often find deals for 10-20% off your purchase, and sometimes even more. Be sure to check the app often for the latest deals.

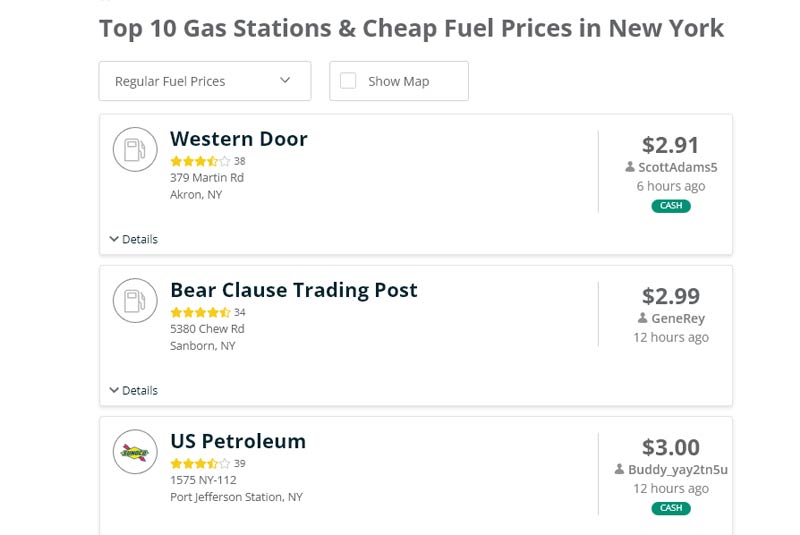

How to save money with Gasbuddy?

Using GasBuddy, you can see the gas prices at different stations and choose the cheapest option. This can help you save money on your gas bill each month. Additionally, GasBuddy’s trip cost calculator can help you estimate how much you’ll spend on gas for a trip, so you can budget accordingly. Many users think that GassBuddy is useful. It has been downloaded over 10 million times and has a 4.5-star rating on the App Store. Many say that it has saved them a lot of money on gas and that it is very user-friendly. Some have even said that it is the best gas price app available!

What other advantages do budgeting apps bring to the table?

- Budgeting apps are fast. If you are someone who is very organized and enjoys using technology, a budgeting app may be a great option for you. It is way faster than using pen and paper, or even spreadsheets. Budgeting apps are designed to be fast and easy to use, and many users find them to be helpful in managing their finances.

- Budgeting apps are easy to use. Budgeting apps can be easy to use, depending on the app and your level of comfort with budgeting and tracking expenses. Some apps are more user-friendly than others, and some may require more time and effort to set up and use effectively. If you’re not sure where to start, there are plenty of reviews and articles online that can help you compare different budgeting apps. Once you’ve found a few that look promising, take some time to explore them and see which one feels the most user-friendly to you.

- Budgeting apps make you accountable. Budgeting apps can definitely help make you more accountable for your spending. Having all of your transactions in one place and being able to see where your money is going can be a real eye-opener. You may be surprised to see how much you’re actually spending on things like coffee or eating out, and this can help you make some changes to your spending habits. If you’re looking to get more control over your finances, a budgeting app can definitely be a helpful tool. Some budgeting apps allow users to set goals and track their progress, which can further motivate them to stick to their budget. Ultimately, even though it works for many people, whether or not a budgeting app makes you accountable is up to you and your individual circumstances!

- They make it easy to categorize expenses. For example, let’s say you have a monthly budget of $1,000 for groceries. You could use a budgeting app to track your spending in this category, and the app would help you to stay within your budget by alerting you if you were close to or over your limit. This could be especially helpful if you tend to overspend in certain categories, as the app would provide a reminder to help you stay on track. Of course, budgeting apps are not perfect, and they will not work for everyone; some people may find them to be too restrictive.

- They provide useful money reports. Many budgeting apps offer features that allow users to export their data into a format that can be easily shared with others, such as a PDF or spreadsheet. This can be helpful in identifying areas where money is being wasted, as well as providing a way to keep track of progress toward financial goals.

Are there any other ways in which these budgeting apps include can help you?

Yes, there are a few more ways in which budgeting apps can help you:

- They can help with credit scores. Budgeting apps can most definitely help with credit scores! By tracking your monthly spending and income, you can better understand where your money is going and make adjustments accordingly. This can help you free up more money to put towards paying off debt, which in turn will help improve your credit score. Additionally, some budgeting apps also have features that allow you to track your credit score and credit utilization, which can further help you stay on top of your credit health.

- They can help with bill negotiation. Budgeting apps can definitely help with bill negotiation! By keeping track of your spending and knowing where your money is going, you’ll be in a much better position to negotiate with creditors and get the best possible terms on your bills. In addition, many budgeting apps offer features like bill reminders and payment tracking, which can help you stay on top of your payments and avoid late fees.

- They can help you invest. Acorns is an app that helps people save and invest their spare change. It will give you the possibility to automatically reinvest your spare change into a diversified portfolio of exchange-traded funds (ETFs). This can help you build up your investment portfolio over time without having to make large contributions all at once. Additionally, Acorns can provide you with guidance and advice on how to best grow your investments. Turning innovative business ideas for entrepreneurs into reality often requires a financial investment. This investment can provide the necessary resources and support to bring the idea to fruition, allowing the entrepreneur to launch and grow their business.

Can budgeting apps actually make it harder for you to save money?

Of course, budgeting apps are not perfect. Some can be expensive, and most of them require you to input a lot of data. They also might not be able to provide the same level of customization and flexibility as a traditional budget. But if you’re looking for a way to take control of your finances and save money, budgeting apps are definitely worth considering. But usually, budgeting apps are not expensive. In fact, most budgeting apps are free. While some of these apps do have paid features, they are not necessary in order to use the app and budget effectively. There are a variety of different apps available, so be sure to do your research to find one that best suits your needs. Start with the free ones, and pay attention to pricing and how much they cost, and you won’t have any problem on this side.

It’s important to explore the other side of the coin if you are tempted to start using budgeting apps. But before you do, you should know that there are many people who hate budgeting apps. The main reasons for this are that they find them cumbersome to use, difficult to understand, and often ineffective in helping them manage their finances. Additionally, many people simply do not like the idea of having to track their spending and budget their money, preferring instead to live impulsively and spend whatever they want. To find these people, just check popular user review websites and sort the reviews by the number of stars, starting with those that only gave one-star reviews. You might find out that you have similar values, views, and beliefs.

Budgeting apps may not be worth it if you are not willing to put in the work to make them effective. Just like with any other budget, you need to be diligent about entering your transactions and keeping track of your spending. If you are not willing to put in the time and effort, a budgeting app is not likely to be helpful.

Final words

According to a study done by Bankrate, 63% of smartphone users have at least one financial app. And it looks like younger generations rely more and more on these kinds of tools. If you are in the category of people that don’t yet use a budgeting app, why don’t you give it a try? In the worst-case scenario, you will just abandon them. And if they work, they could bring a lot of improvements to your financial circumstances.