FinTech is a term used to describe new technologies that aim to improve and automate the delivery and use of financial services. FinTech companies typically develop innovative and efficient ways to provide financial services to customers through the use of technology. This can include everything from developing new mobile banking apps to using artificial intelligence to help customers make better investment decisions.

FinTech simply refers to financial technology. And more specifically, new financial technologies that aim to improve and automate the delivery and use of financial services.

How has FinTech evolved, what is the recent history of FinTech?

FinTech is still a relatively new industry, and it is constantly evolving. As new technologies emerge and as the needs of businesses and consumers change, we can expect to see even more innovative FinTech products and services in the years to come. Even though the term FinTech was popularized in the 1990s, technology has always been a part of the financial services world. A research paper called “The Evolution of FinTech: A New Post-Crisis Paradigm?” and published in 2016 by a trio of academics from 2 different universities (Ross Buckley from UNSW Sydney, and Douglas W. Arner and Janos Nathan Barberis – both from The University of Hong Kong) divided the FinTech evolution into 3 eras:

- FinTech 1.0 (1886-1967): when it evolved from analog to digital.

- FinTech 2.0 (1967-2008): with the development of traditional digital financial services.

- FinTech 3.0 (2008 – present): with the democratizing of digital financial services.

But if we look at the evolution of FinTech from a more generalized perspective, here are the most important milestones across time:

The development of the automatic teller machine (ATM) in the 1970s was among the first that signaled the start of FinTech. During the 1980s, affordable personal computers made digital innovation accessible to the masses. It was in the 1990s that people began communicating more via the Internet, thus resulting in the creation of new firms such as PayPal, which used technology for financial transactions. As a result of mobile internet access and mobile app usage in the 2000s, mobile FinTech apps experienced a surge in popularity.

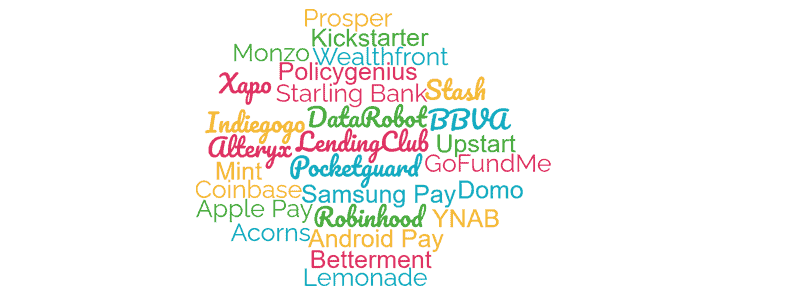

Types of FinTech companies, with examples:

There are many different types of FinTech companies that cater to consumers needing affordable financial services. Here is an overview of the most common types, with examples for each:

- Digital banks: Starling Bank, Monzo, BBVA

- Mobile payment systems (PayTech): Apple Pay, Android Pay, and Samsung Pay

- Investing & Trading platforms (TradeTech): Acorns, Robinhood, Stash

- Peer to Peer Lending platforms (LendTech): LendingClub, Prosper, and Upstart

- Crypto / Digital Wallets / Blockchain: Coinbase, Blockchain.info, Xapo

- Crowdfunding platforms: Kickstarter, Indiegogo, and GoFundMe

- Budgeting Apps (WealthTech): Mint, YNAB, and Pocketguard

- Robo Advisors: Wealthfront, Betterment, and Acorns

- Insurance (InsurTech): Lemonade, Policygenius, and Oscar Health

- Regulatory Technology (RegTech): Compliance.ai, Alteryx, DataRobot, and Domo

Why is FinTech important?

There are many reasons why FinTech is important, here are a few:

- One reason is that it can help to make financial services more accessible to people who might not otherwise have access to them. This is especially important in developing countries, where FinTech can help to provide essential financial services to people who would otherwise be excluded from the formal financial system.

- Another reason why FinTech is important is because it can help to promote financial literacy. This is important because many people do not understand how the financial system works and, as a result, they make poor financial decisions. By promoting financial literacy, FinTech can help people to make better financial decisions and improve their overall financial well-being.

- If we look at it from another perspective, FinTech is important because it can help improve the efficiency of the financial system. This is essential because the financial system is plagued by inefficiencies leading to high costs and slow processes. FinTech can help to address these issues by streamlining financial services and making them more efficient.

- FinTech can help to reduce financial crime. This is important because financial crime is a major problem that costs the global economy billions of dollars every year. FinTech can help to combat financial crime by providing tools and solutions that make it more difficult for criminals to operate.

Overall, FinTech is important because it has the potential to greatly improve the financial system and make it more accessible, efficient, and secure.

Who needs FinTech?

Many people believe that financial technology, or FinTech, is useful only for large corporations and wealthy individuals. However, this isn’t the case. In fact, FinTech can be used by anyone who wants to improve their financial situation.

There are several reasons why someone might want to use FinTech. For example, FinTech might be useful to anybody that wants to:

– Save money on fees: FinTech can help you avoid costly fees, such as bank fees or exchange rates.

– Get a better interest rate: With FinTech, you can often get a better interest rate than what’s offered by traditional banks.

– Invest money: FinTech can be used to invest money in a variety of ways, including through peer-to-peer lending platforms or automated investment services.

– Better Manage their finances: FinTech can help you keep track of your spending, budget better, and make smarter financial decisions.

Small businesses often need access to capital, and FinTech can provide them with alternative financing options such as crowdfunding and peer-to-peer lending. Startups may need help with financial planning and management, and there are many FinTech tools available to assist with this.

Ultimately, FinTech is about using technology to make financial services more user-friendly, efficient, and affordable. And that’s something that everyone can benefit from.

How do FinTech companies make money?

There are a few different ways that FinTech companies make money. One way is by charging fees for their services. This can include things like transaction fees, account fees, and other types of service charges. Another way FinTech companies make money is by lending money to customers and earning interest on those loans. Finally, some FinTech companies make money by selling products and services to financial institutions.

Another way FinTech companies can make money is by selling customer data. Many FinTech companies have access to a lot of data about their customers’ financial behavior. This data can be valuable to other businesses, so FinTech companies may sell it to third parties. A few examples of the most popular ones include Experian, Equifax, and TransUnion. These companies collect and sell customer data to businesses for a variety of purposes, including marketing and credit scoring. Even though you might not be directly affected by this, you should be careful and diligent when reading all their terms of agreement and privacy policies.

FinTech companies can also make money through advertising. They may sell space on their website or app to advertisers, or they may use customer data to target ads to specific users.

FinTech companies vs traditional financial services firms

There are a number of ways in which FinTech companies differ from traditional financial services firms. For one, FinTech companies are generally much more nimble and innovative, able to move quickly to take advantage of new opportunities or meet changing customer needs. They are also often more focused on providing a great customer experience, something that can be lacking at traditional financial institutions.

Another key difference is that FinTech companies are often built around cutting-edge technology, whereas traditional financial firms tend to be reliant on older, more established systems. This gives FinTech firms a significant advantage when it comes to developing new products and services or implementing new technologies.

FinTech companies are often less regulated than traditional financial firms, giving them more flexibility to experiment and innovate. This can be a double-edged sword, however, as it also means that they may be subject to less oversight and protection for consumers.

What is the difference between FinTech companies and banks?

FinTech companies are often much more willing to take risks than banks. They are more likely to try out new ideas and experiment with new technologies. This willingness to take risks can lead to some failures, but it also means that FinTech companies are more likely to succeed in the long run.

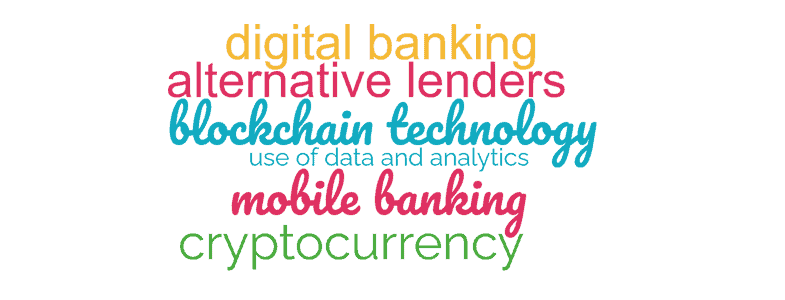

What are the current FinTech trends?

There are a few major FinTech trends that are currently driving the industry. First and foremost among these is the move towards digital banking and mobile banking. This trend is being driven by the increasing popularity of smartphones and tablets, as well as the growing number of people who are comfortable conducting financial transactions online.

Another major FinTech trend is the rise of alternative lenders. These lenders are often able to provide financing to small businesses and consumers who might not qualify for traditional bank loans. The growth of alternative lending has been fueled by the increasing difficulty of obtaining bank loans, as well as the higher interest rates and fees charged by traditional banks.

One major FinTech trend is the increasing use of data and analytics. This data is being used to help assess risk, make lending decisions, and target marketing efforts. The use of data and analytics is expected to continue to grow in the coming years, as more companies seek to obtain a competitive edge by using this information.

The rise of cryptocurrency and blockchain technology is another major trend that heavily influences the FinTech space. Cryptocurrencies like Bitcoin and Ethereum have become increasingly popular in recent years, and blockchain technology is being used to create new financial services and applications.

What are some examples of FinTech stocks?

Some examples of FinTech stocks would include companies like Square, Robinhood, and SoFi. These companies are all involved in different aspects of the financial technology industry and have seen tremendous growth in recent years. Square, for example, provides mobile payment solutions that have made it easier for small businesses to accept credit and debit card payments. Robinhood is a commission-free online broker that has popularized investing among a younger generation of investors. And SoFi is a leading online lender that offers competitive rates and terms for student loan refinancing, personal loans, and mortgages.

What are the challenges of FinTech?

There are a few key challenges that face FinTech companies today. Firstly, there is the challenge of regulation. The financial sector is one of the most heavily regulated industries in the world, and new entrants into the space often have to navigate a complex web of rules and regulations. This can be a significant barrier to entry, and it can be difficult for FinTech startups to get off the ground.

Another challenge facing FinTech companies is the need for significant investment. The financial sector is a capital-intensive industry, and FinTech firms often need to raise large amounts of money to get started. This can be difficult to do, especially for early-stage companies.

And there is the challenge of competition. The financial sector is a large and established industry, and there are already many well-established players. This can make it difficult for new FinTech firms to gain a foothold in the market.

Another big challenge for FinTech is security. Because financial information is often stored electronically, it can be more vulnerable to hacking and other forms of cybercrime. This is a major concern for both consumers and businesses, and it is something that needs to be addressed in order to ensure the continued growth of the industry.

Another challenge facing FinTech and worth mentioning is education. Because the industry is so new, many people are not familiar with it or how it works. This lack of understanding can lead to mistrust and confusion, which can prevent people from using or investing in FinTech.

As you can see, the challenges of FinTech are numerous and varied. But perhaps the most significant challenge is the need to keep up the pace with the rapidly changing landscape of financial technology.

Is FinTech going to stay? And why should you care?

FinTech, being a relatively new and evolving industry, presents a dynamic landscape for ideas in entrepreneurship. Despite its uncertain future, there is widespread excitement about the potential for FinTech to bring about a revolutionary change in the financial services industry. New technologies are emerging that have the potential to disrupt the way that financial services are delivered, from payments and lending to investment management and insurance. But there are several factors that could impact the future of FinTech. For example, if traditional financial institutions start to adopt more of the technologies that are popular in the FinTech world, that could cut into the market share of FinTech companies. Or, if there’s another economic downturn, that could lead to people being less willing to take risks with their money, and that could hurt FinTech companies as well.

It’s really impossible to say for sure what the future holds for FinTech. But it’s definitely an industry to watch, and you should care about it because it has the potential to change the financial landscape in a big way.