It may seem overwhelming if you’ve never created a budget before. But once you understand the benefits of budgeting and learn some easy tips for creating one, it will become second nature. Many resources and tools are available to help you make and stick to an actionable budget. This article outlines the best budgeting tips for beginners and provides personal examples of how to put them into practical use for everyone.

- Don’t be too hard on yourself

- Choose your goals first

- Emergency funds are underrated

- Do budget planning in your spare time

- Budget planning is 99% about how you spend money

- Use the best budget planning strategy that fits your needs

- Try to keep bills and receipts close when budgeting

- Use budget planning to plan ahead for large purchases

- Mark a no-spend day in your budget plan

- Use cash to limit budget leaks

- Use the power of habits when sticking to a budget plan

- In your budget plan, set aside money for discounts & bargains

- Trim your budget – reduce cell phone bills and cut cables

- Separate fixed expenses from variable expenses when you budget

- Use public transport if possible, try to walk more instead of driving

- Cut unuseful habits that cost money from your budget plan

- Do budget plan reviews frequently – review spending patterns

- Budgeting tips for inconsistent income

- Try an online budgeting tool – maybe it’s more convenient for you

- Expect the unexpected – work hard on your savings

1. Don’t be too hard on yourself

It’s like learning to drive a car. It takes time and patience to learn how to budget. It’s difficult because it requires you to think about money in a different way. For example, people who do budgeting must often make decisions based on long-term goals rather than immediate gratification. This can be challenging for some people, who may be more accustomed to thinking about money in terms of immediate needs. Budgeting is also a complex topic with many different facets. For example, in budgeting, you will eventually understand concepts such as “needs”, “wants,” zero-based budgeting”, “envelope cash systems”, and so on. These are not easy to grasp, but they are not very complicated either. Think about it this way: it’s like opening a jar of pickles. You have to use some effort to open the jar, but removing the lid makes it very easy to remove the cucumbers.

It’s important to be mindful of how you talk to yourself when you venture into the realm of budgeting. The good news is that you can work with it even if it’s not perfect. For example, maybe the first time you forgot to budget your pet’s food. When you realize the mistake, adjust the budget plan. Do it even if you have to do some cuts. Maybe less eating out. Perhaps fewer online subscriptions.

Embrace the imperfections and use them to your advantage. Let them add character and charm to your day, and don’t be afraid to adjust. Maybe you can find some cheaper pet food with this opportunity. If you’re constantly putting yourself down or berating yourself for small budgeting mistakes, it can take a toll on your mental and emotional health. Remember that you’re human and that everyone makes mistakes. Among all the budgeting tips, the first one is the most important: cut yourself slack and try to focus on the positive. There’s no need to be too hard on yourself. Do it like you’re in it for the long term.

2. Choose your goals first

This advice is solid overall and shines especially as one of the best budgeting tips for beginners. Having clear goals gives you something to focus on and work towards. Budget planning goals will be more concrete than other life goals and can be tracked easily. And even partial results will help to keep you motivated and on track. Compare the motivation power of a vague goal like “getting married to a cute guy” to building a $1,000 emergency fund. After you put aside some cash, even as low as $300, you can already look back with satisfaction, and because of this, it will be easier to maintain enthusiasm and stay focused. Your goals should be specific, measurable, achievable, relevant, and time-bound (SMART).

3. Emergency funds are underrated

In budgeting, an emergency fund is a fund set aside to cover unexpected expenses, such as a job loss, medical emergency, or home repair. Achieving financial stability by having sufficient savings to handle unexpected expenses, such as medical bills or car repairs, is one of the smartest budgeting tips you can put into practice.

Emergency funds are underrated because people do not think they will ever need them. If people do have extra money, they may not see the need to have an emergency fund as they may feel that they can rely on credit cards or other forms of borrowing in the event of an emergency. They don’t understand or know the high cost of borrowing money fast. The cost can be financial or social if you borrow from friends. Yes. this kind of action puts a strain on your relationships. And can cost you up to two or three times the money you could have saved in the first place. Usually, people understand the importance of having an emergency fund only after they have their first emergency, and usually after they are already in debt and regret it. That is why learning it from other people’s experiences is important. And it is even more important if you start a budget plan because budgeting offers a good framework for building emergency funds. Just set aside $50 every month in an emergency fund. Or even less! Just think about it: how much money would you have in an emergency fund if you put aside $50 every month and if you started ten years ago?

According to the report on the Economic Well-Being of U.S. Households in 2020 – May 2021 by the Federal Reserve, 39% of Americans would have a hard time covering an unexpected cash expense of just $400. This means that a relatively small and unexpected expense, such as a car repair or replacing a broken appliance, can be a hardship for many families. Basic budget planning could help these people build an emergency fund without feeling any serious burden by regularly saving a very small sum of money. You need to set aside just $35 every month, and in a year, you’ll have a $400 emergency fund as a backup. If you need more motivation to start budgeting, read this article about budget planning statistics.

4. Do budget planning in your spare time – think about needs vs. wants

This is one of the hardest budget tips to put into practice, but one that can have a major impact on your results. When you do budgeting, it is crucial to prioritize your spending and allocate your funds in the smartest way possible. An effective budget needs to take into account what you need and what you want. For example, when you need to buy a car, it’s not just about the price tag—you must decide whether it is a need or a want. I have broken down the needs and wants in a recent article about the different budget planning strategies. They are actually part of the 50 / 30 / 20 budgeting strategy; check it out if you want more concrete examples.

Unfortunately, many people live above their means and cannot afford the lifestyle they want because of their monthly expenses. If this sounds like you, look at your financial situation and see where you can cut back (especially in the wants department) to save money for the things you need.

Working on a budget does not mean you cannot enjoy yourself at all; it simply means having a plan for how much money you can spend on different things every month so you don’t go over budget. Lack of enjoyment in your plan is not necessarily good because you will eventually burn out and stop doing it. Just be careful about what you want and what matters to you. And if these things are included in your budgeting plan, you just have to worry about following it.

Another trick you can do in your daily routine is to do this thinking process whenever you have spare time. This can be done in the evening, before bed, whenever you have to wait for a meeting, appointment, or even food. You don’t have to have dedicated time for it or even have to do it when you do the actual budget plan. Just think about it in your spare time, clarify what is you need and want, and apply that knowledge when you do the actual budgeting.

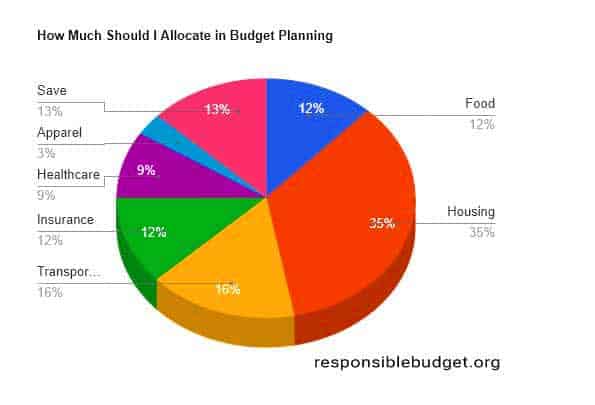

5. Budget planning is 99% about how you spend money

Most of the effort when you do budgeting is placed on spending patterns, habits, and decisions. People typically start their month off by allocating a certain amount of money for different expenses like rent, groceries, transportation, etc., and then they break down expenses even further into subcategories like food, clothes, entertainment, etc. But, after the budgeting is done, the reality kicks in, and the real issue becomes this: did you spend more than you allocated? Staying constantly within the allocated ranges comes with experience after much trial and error, so don’t discourage yourself if you don’t manage to do it all the time. If you realize before you start your budget plan that spending habits are the most important part of the budgeting process, you won’t have such a big shock when your budget plan meets reality. With experience, you will become more aware of spending patterns. This is one of the best tips for budgeting because it brings a compounding advantage for people who do budget planning over those who don’t.

6. Use the best budget planning strategy that fits your needs

You can do budget planning in many ways, and they are called budget planning strategies. I outlined 5 of them in a previous article:

- The Classic Budget Planning Strategy

- The Zero-Based Budget Planning Strategy

- The 50 / 30 / 20 Budgeting Strategy

- The Cash Envelope Strategy

- The Pay Yourself First Budgeting Strategy

Each comes with its advantages and disadvantages. For example, the cash envelope budget strategy tracks how much money you have left in each budget category. This is helpful for people because they can easily differentiate between cash for rent, gas, food, or groceries, and they can spend only as much as they decide at the beginning of the month. This is one of the budgeting tips that have a psychological aspect to them, giving people peace of mind that they aren’t spending the rent money on some fabulous shoes. The only disadvantage is that you have to carry around multiple cash envelopes.

Another example is the pay-yourself-first budgeting strategy: put aside money into savings first whenever your paycheck comes in, then budget the rest. This is a good tip for people who have trouble sticking to plans.

Each budgeting strategy has advantages and disadvantages. Make sure you review all of them and choose the one that best fits your style. Then, you will have a way easier time budgeting for the rest of the year.

7. Try to keep bills and receipts close when budgeting

There are a lot of people who choose to keep all of their bills and receipts to have a complete record of their expenses. But did you know that there are budget planners specifically designed to store bills and receipts? For example, the Mead Organizer Expense Tracker has separate pockets for bills and receipts, which is uncommon among top budget planners. If you are one of the people who keep all of their bills and receipts, then the Mead Organizer Expense Tracker will complement your abilities well. Trying it is a good tip for organized people. With this budget planner, you will get two monthly pockets to separate the bills from the receipts. This feature makes the budget planner much more attractive because your papers will be stored in the same place in which you review your spending, so they will come in handy.

Among these personal budgeting tips, my favorite is to scan or photograph your bills and receipts so that you have a digital record. You can create digital folders for different types of expenses, making it simpler to find the information you need when you need it. Scanning your bills and receipts and keeping them in the cloud can give you extra peace of mind in case of loss or damage. If you have a digital copy of your documents, you won’t have to worry about replacing them if they are lost or destroyed. Scanning your documents can help you declutter your home or office, as you won’t need to keep physical copies of everything. It will also allow you to use budget planners without pockets or room for bills and receipts, which are usually smaller, lightweight, and easy to carry around, like the Clever Fox Budget Planner.

8. Use budget planning to plan ahead for large purchases

It’s always a good idea to plan ahead for large purchases. By setting aside money each month specifically for your large purchase, you can do it without getting into debt and paying unnecessary interest rates. A combination of savings and borrowing may do the trick when planning a large purchase. Some stores offer to finance big-ticket items, which can help make the payments more manageable, but you will end up paying more out of your pocket just because you did not have enough money when you made the purchase. Planning your budget and saving for what you need is the best long-term solution, one of the best tips for budgeting, in which you pay the least for what you want.

9. Mark a no-spend day in your budget plan

A no-spend day is, simply put, a day where you don’t spend any money. This is one of the budgeting tips that can be tricky to do if you’re used to spending money every day, but it’s a great way to save money and get your finances under control. There are a few ways to go about having a no-spend day. First, you can plan ahead and ensure you have everything you need for the day so you don’t have to go out and buy anything. This might mean doing some grocery shopping the day before or packing your lunch instead of buying it. Second, you can make a rule for yourself that you won’t spend any money today, no matter what. This can be tough, but it’s a good way to test your willpower. Finally, you can try to find free activities to do instead of spending money. This might mean playing some old computer games that don’t cost any money, going for a walk in the park instead of going to the movies, doing some meditation yoga, listening to music, or borrowing a book from the library instead of buying one. It’s a good tip to do extensive research about these kinds of activities and select the ones you enjoy the most. No matter what activities you choose, a no-spend day can be a great way to save money and get your finances under control. Do this as many times as possible.

10. Use cash to limit budget leaks

A budget leak is a situation in which money is spent unplanned. This means that money is spent outside the budgeted amount without much consideration at the time of purchase. This can happen for various reasons, but usually, it is because people are not sticking to the budget or because unexpected expenses come up. It is associated with easy and fast purchases when credit card details are saved in the payment system or with payment processors like Paypal, where you can easily set pre-approved payments. Most of the time, budget leaks are simply due to careless spending, such as when someone buys something without knowing whether or not it is within the budget. If you find yourself in a similar situation or if you are someone who tends to overspend, switching from digital currency to paper-based currency can solve most of the problems. With cash, you have more control over your spending because you are limited to the amount of cash you have on hand. And you’ll never have to worry about paying interest on cash. Also, the physical process of getting them, counting them, and the process of letting them “fly away” from your actual hands, may give you some room for having second thoughts about the purchase. This is one of the simple budget tips that can stop you from spending money.

On the other hand, credit cards offer several advantages over cash, including building credit, earning rewards, and enjoying protection against fraud and theft. You also have the ability to build your credit history and improve your credit score by using credit cards responsibly. However, they can also lead to debt if you’re not careful, and you may be charged interest and fees if you carry a balance. But if you are disciplined with your spending and pay off your credit card balance in full each month, you may find that the credit card rewards and convenience of using a credit card make it the better choice for you.

11. Use the power of habits when sticking to a budget plan

Habits help us automate our behavior to do things without thinking about them too much. This frees up our mental energy for other tasks. There are many benefits to developing good habits. Habits can help us to become more efficient and productive, make better decisions, and to stick to our goals. And they work especially well for budgeting.

Here are some examples of habits that could be very useful when doing budget planning. They are good budgeting tips even for experienced budget planners:

- Write down expenses as soon as possible. Ideally, it could be done as soon as the money is spent, in a small budget planner you carry with you all the time. But let’s be realistic; most of us won’t be able to do it like this. The second best thing would be to find some spare time just before bed or after waking up. This way, you have everything fresh in your head. You can mentally break down the past day and write down everything about spending money. Do this every day until it becomes a habit.

- Review and adjust. Your budget should be a fluid document you review and adjust as needed. As your circumstances change, so too should your budget. Review your budget plan regularly to ensure it’s still meeting your needs. This also can be done among the first things you do in the morning or evenings, maybe once a week (on one of the weekend days). If you repeat it enough times, it will become a habit.

- Making a list before shopping is another habit that can help you stay on a budget. This is an excellent tip to help you stick to your budget by buying only necessary items. List-making can become a habit like any other if you do it repeatedly.

- Live below your means. Just because you can afford that new car or designer handbag doesn’t mean you should buy it. If you want to stay within your budget, it’s important to live below your means and only spend money on what you need. While it may not be the most exciting way to live, living below your means is a great way to build long-term financial stability.

12. In your budget plan, set aside money for discounts & bargains

If you’re looking to save money in the short term, then discounts may not be the best option for you. However, if you aim to build up your savings over time, taking advantage of discounts could help you reach your goal sooner. Many stores offer discounts on certain items or during sales, so it is wise to set some extra cash aside to take advantage of these deals. Seasonal discounts are typically offered on seasonal items, such as winter clothes during the winter season. They are a way for retailers to clear out stock and make room for new inventory. So, the best time to buy some winter clothes is not at the beginning of the winter (when most people buy them) but at the beginning of spring, when the retailers want to make room for new inventory. You can have huge savings if you factor this knowledge into your budget plan. This is one of the budgeting tips that is harder to implement because the trick here is having the money way before the actual need. The only disadvantage is that you might not be on top of trends because you buy your clothes for the winter in the spring. However, this should not be a problem for most of us.

13. Trim your budget – reduce cell phone bills and cut cables

There are several ways that you can trim your budget to save money. One way is to cut back on unnecessary expenses such as eating out or buying new clothes. Another way is to find ways to reduce your monthly bills, such as by negotiating with your service providers or looking for more affordable options. Cell phone bills are the prime candidate in this case. There is absolutely no reason why you should pay a lot of money to your cell phone service provider (excluding some specific cases). Cable TV is not as popular as before, especially among young people. According to a 2017 report from eMarketer, the number of people in the US who watch cable TV has been declining since 2010. In 2010, about 100 million people in the US watched cable TV. By 2017, that number had declined to about 86 million. Are you among those who don’t watch cable TV but still pay for it? If so, this is the right moment to take action.

14. Separate fixed expenses from variable expenses when you budget

Fixed expenses are costs that stay the same each month, such as rent or a car payment. Variable expenses are costs that can fluctuate from month to month, such as groceries or gas. When budgeting, the trick is to consider both types of expenses to make accurate financial plans. Seeing where you can cut back or save money can be difficult if all your expenses are lumped together. However, breaking your expenses into categories can make it much easier to see where to make changes. For example, if you see that you’re spending a lot of money on dining out, you may scale back in this area to save more overall. If you know how much you typically spend in each category, you’ll be better equipped to handle unexpected expenses when they come up.

15. Use public transport if possible, try to walk more instead of driving

Public transportation can often be cheaper than owning and operating a vehicle. And in some cases, public transport can be even more convenient, especially if you live in a city with a good public transport system. It can save you money on parking and gas and is often faster than driving in heavy traffic. Taking the bus or train can also be a more relaxing way to travel since you can sit back and read or listen to music while someone else does the driving. Public transportation is also good for the environment. Buses and trains emit far less pollution than cars, so using them helps reduce air pollution and climate change. And, since public transportation can carry more people than private cars, it reduces the number of vehicles on the road, which saves energy and reduces traffic congestion.

For your budget planning, it can do wonders, especially in the savings department. The amount of money you can save by using public transportation will vary depending on several factors, including the cost of gasoline, the actual cost of public transportation, the distance you typically travel, and your driving habits. However, you can generally save a significant amount of money by using public transportation instead of driving. A good tip here is to take advantage of any discounts or deals that your public transportation system offers. For example, many systems offer discounts for seniors, students, frequent commuters, and low-income riders. If you qualify for any of these discounts, be sure to take advantage of them.

If public transit options are not readily available or reliable, they may not be the best option for you. It may not be easily accessible from your home or workplace. It can also be quite inconvenient, especially if you live in a rural area.

Walk more. Walking is a great way to save money while getting some exercise; it has many benefits and is one of the easiest budget tips to put into practice. It can help you lose weight, improve your cardiovascular health, and increase your fitness. Walking is also a low-impact form of exercise, which means it is easy on your joints and muscles. This includes walking to work, to the store, or running errands. Walking can be a great alternative to driving and save you money on gas and parking fees if you live close enough to where you need to go.

16. Cut unuseful habits that cost money from your budget plan

Many habits can cost money, depending on how often they are indulged in and how expensive they are. For example, smoking cigarettes can be quite costly, as can drinking alcohol or going out to eat frequently. Other habits that can cost money include shopping, gambling, and travel. Essentially, any habit that involves spending money regularly can cost a lot over time. After you track your expenses for a few months in a budget plan, you can clearly see the burden this habit puts on your finances. Breaking old behavior patterns and establishing new, healthier ones can be difficult. However, it is possible to do so with dedication and effort. This is one of the hardest budgeting tips for beginners. Many resources are available to help people give up bad habits, and with the right support, it is possible to make lasting changes, but the trick is finding the one that works for you. First, identify them and then start doing research on how to break or replace them.

17. Do budget plan reviews frequently – review spending patterns

Reviewing your budget plan regularly is a good idea to ensure you’re still on track. This is one of the best tips on budgeting that can help you avoid overspending and getting into debt. You may also want to adjust your budget if your income or expenses have changed.

Some things you might want to consider when reviewing your budget plan include:

- Are you spending too much money in certain areas?

- Are you consistently spending what you plan for?

- Are you saving enough money each month?

- Are you on track to reach your financial goals?

- Do you need to adjust your budget to account for any changes in your income or expenses?

On the other hand, if your finances are in good shape and you’re not trying to make any major changes, you may not need to review your budget as often. Ultimately, deciding how often to review your budget based on your circumstances is up to you.

18. Budgeting tips for inconsistent income

An inconsistent income is defined as an income that varies significantly from month to month. This type of income can make it difficult to budget and plan for your financial future. There are a few different reasons why someone might have an inconsistent income. Perhaps they are self-employed, or their business fluctuates seasonally. Or maybe they work on commission, and their earnings depend on how many sales they make. Whatever the reason, living with an inconsistent income can be challenging.

The first tip for budgeting is to build up an emergency fund to have a cushion to fall back on when your income is low. There is no excuse for not building it. The fact that your income is inconsistent means that sometimes it’s high, and sometimes it’s low. It does not mean it’s always low. When it’s high, you need to set money aside for the times when it will be low. Basically, you have to work against your natural impulses and try to cut back on your expenses as much as possible when the times are good.

The second tip for budgeting is to try to find ways to supplement your income with other sources of income. This could include picking up odd jobs, starting a side hustle, or finding creative ways to make extra money. Find something that allows you to work at any time, even if the payout is lower. This will help you to stretch your budget further and make ends meet when your income is low. Identifying business idea examples that allow for flexible work hours, even with lower payouts, can help you maximize your budget and ensure financial stability during times of low income.

And the third tip for budgeting is to try to understand your spending patterns better. This will help you budget more effectively and ensure you are not overspending when you have a good month. If the average income you earn is decent, then the actual problem is not the income but the spending. Try to analyze it as best as possible and control it.

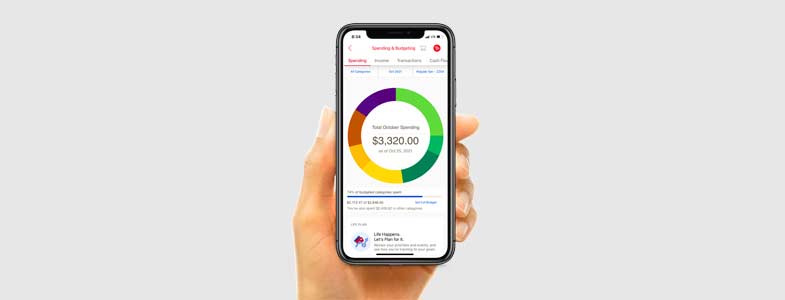

19. Try an online budgeting tool – maybe it’s more convenient for you

Several online budgeting tools are available to help you keep track of your finances and make better spending decisions. Some popular options include Mint, You Need a Budget (YNAB), and EveryDollar.

Mint is a free online budgeting tool that connects to your bank account and automatically tracks your income and expenses. It also provides helpful features like bill reminders and a credit score tracker.

YNAB is a paid budgeting tool that helps you “gain control of your money, get out of debt, and save more money.” It offers goal tracking, bank synchronization, and transaction categorization features.

EveryDollar is another paid budgeting tool that offers a simple, straightforward way to track your income and expenses. It also includes features such as debt payoff assistance and custom budgeting templates.

This is one of the easiest budgeting tips to try in practice. The trick with these kinds of apps is to find one that you actually use regularly. Try some and see if anything sticks!

20. Expect the unexpected – work hard on your savings

The final one from our list of good budgeting tips is to expect the unexpected. This means being prepared for anything that might happen. It’s important to be ready for anything that comes your way because you never know what might happen. The best thing you can do for the unexpected in budget planning is to work towards savings. It can feel very liberating to have an emergency fund in place. It can provide a great sense of security, knowing you have a cushion to fall back on in case of unexpected expenses or unforeseen circumstances. For many people, having an emergency fund can be the difference between financial stability and financial chaos.